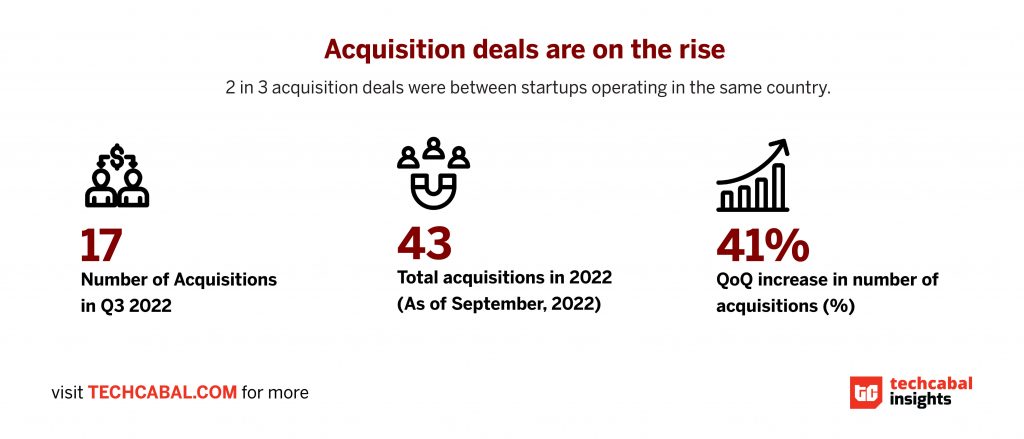

The TechCabal Insights report has shown that there has been an increase in the number of tech acquisitions in Africa, with a total of 43 deals by the end of Q3 2022. This indicates a consolidation trend and shows that the tech market is maturing.

VC investment has hit a plateau in the last quarter, with startup companies resorting to cost-cutting measures and acquisitions in order to stay afloat. This is particularly apparent in markets where there is already significant competition among businesses. The percentage of startups acquiring another business in the same market has increased from 31% in Q2 to 52% in Q3 2022.

The State of Tech in Africa Report compiled by TechCabal Insights, also found that the average seed ticket size remained stable at $2.5M in Q2 and $2.7M in Q3.

A new narrative has emerged in Africa in recent years, embodied by the exponential growth of funding for technology startups. Investment in African startups grew 18x between 2015 and 2021 and 2x faster than global rates between 2020 and 2021. However, beyond the funding stories, there are the quieter tales of exits. By the end of H1 2022, African-focused private capital investors had already made 22 full exits, representing about a 29% increase compared to the 15 exits made in 2021 H1.

Commenting on the findings of the report, Olanrewaju Odunowo, Head of TechCabal Insights, said “When it comes to Africa’s evolving tech ecosystem, appropriate context and nuances must be taken into account. Data without context is imbalanced and misleading and can lead to the wrong outcomes. Beyond crunching the numbers, we have gathered robust insights drawn from primary interviews with leading industry experts. Our aim with this report is to present easy-to-digest insights and data points that anyone – from founders to investors – will find valuable. ”

The State of Tech Report Q3 is available to access for free on http://bit.ly/3Aw25vx