Otavio Veras, Researcher of the NTU-SBF Centre for African Studies

Synopsis

The East African Community (EAC) is an economic bloc formed by Kenya, Tanzania, Uganda, Rwanda and Burundi. The countries have a history of cooperation dating back to the early 20th century. In the recent years, they have started various infrastructure projects to improve the connection between its members, ultimately decreasing the cost of doing business and making the bloc more attractive to trade with foreign countries.

Singapore is enjoying this opportunity, with investments in the African continent growing at a compound rate of 12% per year[1]; the city-state has traded more than US$400 million with the EAC alone in 2013. Singapore is currently involved in various businesses in the region, ranging from agriculture to digital logistics solutions, and is eager to expand its presence even more. This pace will increase as legal frameworks and institutions covering the whole EAC bloc gain strength and eliminate corruption in the region; and when basic infrastructure problems are solved and an easy flow of goods and services is reached in the region.

The East African Community

Surrounding the pristine Lake Victoria, Kenya, Tanzania and Uganda formed the original core of the East African Community (EAC), which came into force in July 2000. Neighbouring countries Rwanda and Burundi joined the Community in 2007[2]. The 5 countries are home to 157 million citizens, have a combined Gross Domestic Product (GDP) of US$147 billion and an average annual GDP growth of over 6% projected for the coming 2 years[3]. The EAC came together to establish a common trade bloc with open borders to free up the transit of capital and citizens, and an ultimate goal to have a common currency and turn the group into a political federation, with a single sovereign state.

With the motto “One People, One Destiny”, the Community has created the East African Customs Union, established the Common Market in 2010, and implemented the East African Monetary Union Protocol. These are just some of the steps the EAC has taken in order to attract investments, nurture economic growth and reduce poverty.

In all of its 5 countries, there is a sentiment of pride and hope that this union will keep bearing good fruits. There is a joint effort to make several changes to the national laws to allow the full implementation of the common market in areas such as immigration, labour and customs.

Challenges that the EAC faces are mostly related to poor infrastructure, such as inefficient border posts, road blocks, transit road weighbridges, long clearances at ports, and poor roads and railways. Corruption[4] is also a problem, with 4 of the 5 countries ranking over the 100th position among the most corrupt in the world. Rwanda has the best score, with a ranking at 44. These challenges, however, in themselves constitute opportunities for companies understanding Africa and willing to engage in infrastructure development.

Trade integration

One of the main aims for the creation of the EAC bloc was to decrease or eliminate tariff barriers for trading goods among the members of the Community. Kenya largely benefits from bilateral trading agreements with other country members of the EAC. In 2014, Kenya exported goods worth more than US$900 million to Uganda, Tanzania and Rwanda. Uganda ranked as the main trading partner of Kenya, having imported more than US$470 million in Kenyan goods in 2014, according to the Kenya National Bureau of Statistics. Kenya traditionally exports lime, cement, fabricated construction materials and consumer goods to Uganda.

The bilateral relations between Kenya and Uganda also extend to the oil and gas sector. In August 2015, the countries decided on the crude oil pipeline that will transport oil from Albertine to Lokichar in Turkana County, the Hoima-Lokichar-Lamu oil pipeline. The agreement also includes the development of an oil refinery in Uganda[5]. However, it does seem that Uganda is also exploring opportunities with Tanzania for the export of its oil via Dar es Salaam. Time will tell as to what option Uganda will eventually follow.

In 2015, Tanzania was Kenya’s second largest export destination within the EAC, with products like soap, foodstuffs, cleansing and polishing preparations as the major exports[6].

The decrease of tariff barriers incentivizes trading within the bloc. As trading and competition increase, buyers start demanding better quality products. The quality of some Ugandan products is now rivalling that of items, which for example, Rwanda previously imported from South Africa. The EAC integration means that Rwanda has to apply tariffs to products from the Southern Africa Development Community, while Ugandan goods are basically entering a domestic market. In the third quarter of 2015, Rwanda imported a total of US$126 million from other EAC countries, 26% of the total imports. Of these, 50% come from Uganda, making it Rwanda’s main trading partner in the bloc[7].

Improving Infrastructure

There is much to be done to interconnect the 5 countries of the EAC. The poor state of infrastructure across borders is one of the critical elements dragging down the economic growth in the region. The states have committed to improve road and railway systems, port conditions and electricity distribution grids in order to elevate the economies to a medium income level within the next decade. After addressing these basic infrastructure problems, the countries will be able to spark a rapid industrialization process. The final objective is to increase trade between the East African Community members, to reduce the cost of doing business, and to facilitate the movement of people, goods and services across borders.

Railways

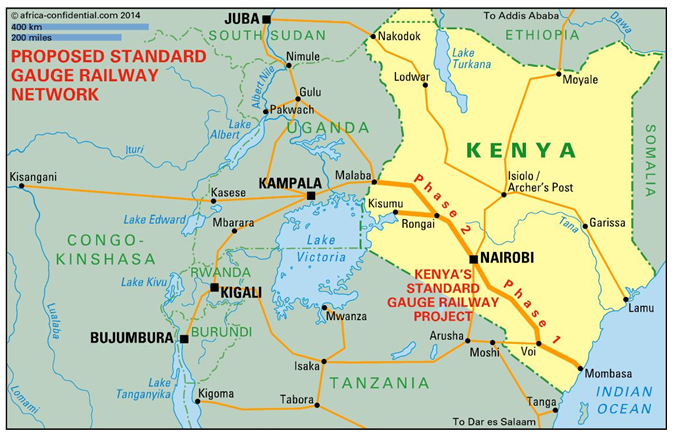

Currently the railway systems connecting the countries are old, lacking maintenance. In Kenya, the construction of a new railway system was started in October 2013 to provide a more efficient integration between two of the country’s most important cities: the capital Nairobi, and Mombasa, the largest port in East Africa. The Standard Gauge Railway (SGR), which is built to copy the most efficient railways in China, will be 609km long and is expected to be completed by the end of 2017. It will transport passengers and cargo. The project will cost US$3.8 billion, being 90% financed by the China Exim Bank and 10% by the Kenyan government. The new railway line constitutes the first phase of the SGR project that aims to connect Kenya, Uganda, Rwanda, Burundi and South Sudan.

The railway is the biggest transportation project in Kenya since its independence, and it will shorten the travel time between Mombasa and Nairobi from 10 to 4 hours. Freight trains will complete the journey in less than 8 hours. The railway line is designed to carry 22 million tonnes of cargo a year or a projected 40% of Mombasa Port throughput by 2035[8].

More than 30,000 jobs are expected to be created during the construction. Today many Kenyan families can already thank the project for the economic growth the region is experiencing. The contract, signed by the local government and the construction company, China Road and Bridge Corporation (CRBC), has assured that a large percentage of the workers are locals, and not foreigners.

Besides direct employment, the construction of the SGR is also making room for many new openings in companies that provide supporting services, such as security, transportation, accommodation and catering. Currently, construction materials, fuel, equipment, vehicles, sub-contracting works and consulting services are provided by local suppliers, while steel rails, steel strands, and other steel components have to be imported. The local steel industry is evolving, but has not yet reached the internationally recognized safety and quality levels required for the project[9].

In addition to the Mombasa-Nairobi connection in Kenya, inter-nations agreements have been signed to extend the railway to the adjacent countries. The governments of Kenya and Uganda signed a memorandum of understanding (MoU) in October 2009 to construct the SGR line from Mombasa to Kampala, the capital of Uganda. The railway will reduce transportation costs of goods from Mombasa to Kampala by up to 58%[10].

In August 2013, Rwanda joined the agreement, which would extend the railway from Kampala in Uganda to Kigali, the capital of Rwanda. The SGR line from Mombasa to Kigali is expected to be completed by 2018.

Ports

The ports are also extremely important in the transportation system in the East African Community. The ports of Mombasa (Kenya) and Dar es Salaam (Tanzania) are vital for the region. The Port of Mombasa not only serves Kenya, but is also the main gateway to the Eastern African hinterland countries of Uganda, Rwanda, Burundi, Democratic Republic of Congo and South Sudan. It is the largest port in East Africa, currently receiving more than 22 million tons of cargo per year[11].

Kenya is working hard to benchmark the performance of its ports with that of highly efficient ports such as Singapore, Rotterdam and Hamburg. To achieve this, the country is harmonizing its sea and inland ports’ operational standards with a focus on international best practices, investing in new technologies, expanding and improving infrastructure, enhancing logistics processes and embracing automation of services. The developments will not only reduce cargo and container dwell times, but will play a greater role in reducing the overall cost of doing business in the region.

To the north of Mombasa, talks about the multi-billion dollar project, the Lamu Port Southern Sudan-Ethiopia Transport (LaPSSET) Corridor, are ongoing. The project will include an 880-megawatt liquid-natural-gas-fired power plant, an oil pipeline to transport crude finds in northern Kenya and neighbouring Uganda, 6 berths at a deepwater port in Lamu, and a desalinization plant[12]. The port is expected to make Kenya a trans-shipment hub because of its deep waters and ability to accommodate large vessels.

Lamu port and adjacent infrastructure are the central pieces of the LaPSSET Corridor, but not the whole of it. The project also includes roads and railway connecting the port to Ethiopia and South Sudan. A Standard Gauge Railway with 1,720km will connect Lamu to Juba, capital of South Sudan, and a two-lane highway will link the port to the cities of Isiolo, in the heart of Kenya, and Nakodok, on the border with South Sudan. Airports will be built in Lamu, Isiolo and in Lokichogio[13].

The LaPSSET project, once completed, will link Kenya to its two northern neighbours, Ethiopia and South Sudan, opening up the region to immense socio-economic development, especially in the northern, eastern and north-eastern parts of the country, and promote cross-border trade. The whole LaPSSET Corridor is estimated to cost US$26 billion and will be fully completed by 2030.

Tanzania is also engaged in improving its ports capabilities. Dar es Salaam is the main port of the country, handling about 90% of Tanzania’s international trade, with an annual capacity of more than 14 million tons of cargo. The port’s performance is far from satisfactory though. According to the World Bank, trade costs are 60% higher between Tanzania and China than between Brazil and China, despite the distance being double.

The Dar es Salaam port situation has not just been a problem for Tanzania. It has also held back neighbouring landlocked countries Rwanda, Burundi, Zambia, Uganda, Malawi and the Democratic Republic of Congo. If the port of Dar es Salaam reaches the same level of efficiency as that of Mombasa, the Tanzanian economy will gain almost US$1.8 billion a year, according to a World Bank analysis, which also said that inefficiencies at Dar es Salaam cost Tanzania and its neighbours up to US$2.6 billion in 2014.

In order to reverse this situation, Tanzania Ports Authority, TradeMark East Africa, the World Bank and the UK’s Department for International Development (DFID), signed a Memorandum of Understanding in September 2015 for an expansion project that aims to increase Dar es Salaam’s cargo handling capacity to 28 million tonnes in 2020 and to 34 million tonnes by 2025. The project has a price tag of US$750 million[14].

Additionally, the construction of a new port in Bagamoyo, located 75km from Dar es Salaam, is expected to start in July 2016. The US$10 billion project includes roads and railways and will take 10 years to be completed. The project is financially backed by China Merchants Holdings, China’s largest port operator, who will also be responsible for much of the construction work. The other partner in financing the project is Oman’s State General Reserve Fund[15]. The new port will be the largest in East Africa and will be able to handle 20 times more cargo than the Dar es Salaam Port[16].

Roads

Road transport projects taking place in Tanzania and Kenya are serving as examples to the other countries of the East African Community of how improvement in infrastructure can generate business and foster economic growth. The Bus Rapid Transit (BRT), operating since early January 2016 in Dar es Salaam, uses a surface metro-like system of roads dedicated to buses, extending for 21km on three trunk routes and with 76 servicing buses[17]. The system is responsible for decreasing traffic jams and shortening the commuting time of passengers in the city.

In Kenya, the 50km Nairobi-Thika Superhighway, launched in November 2012, covers an area that lies within the Nairobi Metropolitan and Central Province, including large sections of the City and Thika district, and covers an area inhabited by more than 1 million people. The highway not only reduced the commuting time between Thika town and Nairobi, but also brought a large number of businesses to its vicinity. New residential and commercial real estate were built, including 7 shopping malls[18].

Near the border with Tanzania, the Kenyan government has started to invite companies to bid for the upgrade of the 172km highway connecting Ahero to Isebania. The project, traversing four counties – Migori, Kisii, Homa Bay and Kisumu, is expected to improve trade in the Lake Victoria basin, which currently struggles with the narrow and worn road. The new highway will be larger and will have special service roads at commercial centres to boost the uptake of goods[19].

Electricity

On the electricity infrastructure flank, there is the Eastern Electricity Highway Project, that will have a total of 1,045km of 500kV power lines extending from WolyataSodo in Ethiopia, to Suswa in Kenya[20]. The US$1.26 billion project will be financed by the World Bank, African Development Bank (AfDB), Agence Française de Developpment (AFD) and by the government of Kenya, and has an environmental and social management plan and a resettlement action plan to take care of the communities that will be affected by the construction works.

The project, which is planned to be completed by the end of 2017, has the objective to increase the volume and reduce the cost of electricity supply in Kenya due to the cheap hydro-power from Ethiopia. The interconnection will also offer alternate power supply to Kenya and Ethiopia in the dry season when hydro generation is dismal. In addition to that, it will develop the pathway to create a regional electricity grid interconnecting the Eastern African countries, including other members of the EAC bloc. This will facilitate power exchange and develop electricity trade in the region[21].

Services and Businesses

In the services arena, a new platform for money transfer between Rwanda and Kenya was launched in October 2015. Users will be able to send and receive money seamlessly and affordably between the two countries. This regional remittance will greatly reduce the cost of doing business across the border, improve trade and increase market competitiveness in the region[22].

Another example of a business that is crossing borders is the Java House, a Kenyan coffee shop franchise that owns 36 shops in Kenya. The company, with revenue of US$29.5 million in 2014, is planning a massive expansion to Nigeria, Ghana, Zambia and Tanzania, following the growing number of coffee drinkers and enthusiasts[23].

What do Singaporean business people have to think before investing in the EAC?

The East African Community offers plenty of opportunities for business, in the most diverse industries. An entry strategy in that market has to responsively adapt the products in the face of different market conditions. Retail products that work in Singapore and are considered common, may be seen as unnecessary perks in another country. Expensive or luxury products would only be consumed by a small elite who value their brands and can afford their prices.

Mass market products seems to be the best bet when entering an emerging market such as the EAC. Profit will likely be achieved through low margin and high volume sales of goods. This would typically entail simple products, with narrow product ranges, and low rates of product obsolescence. Additionally, an ideal distribution coverage should consider the traditional, complex, socially embedded channels characteristic of the EAC.

There are two main strategies that can be adopted by market entrants in the EAC, both of them involving deep product adaptation. The first is based upon the use of global sources, but adapting its marketing mix to make that global asset more suited to local needs. This could be achieved by changing the products’ packaging size, price points, or even their formulation to enhance the local customer appeal.

A different strategy would be to develop new market-specific resources, a more direct but costly and probably a slower approach than adaptation. This involves joint-ventures or the acquisition of local brands that are added to the multi-national portfolio alongside global counterparts. Alternative local resources that might be developed are distribution assets, such as company-specific warehouses or fleets of vans or even bicycles.

In addition, the local competition has to be assessed. Even if the local competitors are small in size, they retain a large knowledge of customers’ preferences and optimum distribution channels.

Retail Singaporean companies with experience in expanding into emerging markets will likely have an advantage there, with lessons learned from previous mistakes and an engaged management team used to face the difficulties found when entering a new market in developing countries.

Businesses that could also have a broad receptiveness in the EAC, are those that improve agricultural yields, as agriculture makes a large part of the economy of the countries in this bloc. Technologies that improve communication and logistics and technologies that help decreasing bureaucracy, will have a great traction with local governments.

The EAC presents a huge market where Singaporean companies can invest and obtain profits. Companies expanding to Africa have not only to be aware of tackling the local customers’ needs and addressing infrastructure and distribution problems, but must also balance the risks inherent in emerging markets, such as non-transparent regulations, bureaucracy and corruption.

Singapore investing in EAC

Singapore is using its extensive experience in urban planning to embark on the development of EAC. Surbana, a Singaporean award-winning international urbanisation consultant, signed a Memorandum of Understanding in 2014 to design a new master plan for Arusha City and Mwanza City in Tanzania. With that the cities will have a proper design for industrial, commercial, and residential areas, and a first class transportation system plan[24]. These are essential to achieve sustainable development, attract businesses and improve the overall living standards of the population.

Another Singaporean company investing in the EAC, is Pacific International Lines (PIL). The company, which has been in the shipping business since 1967, has also diversified into container manufacturing. PIL has an operating fleet of 160 container vessels and, in June 2014, opened a branch office in Tanga, Tanzania, showing its commitment to grow in the region.

Olam has a large presence in East Africa too. It began operating in Tanzania in 1994, with its head office in Dar es Salaam and branches spread out in 5 other cities. The company manages an integrated supply chain for 4 key products, i.e. cotton, sesame, cocoa, and green coffee. The company expanded to Uganda in 1997, where it transacts the same products and imports and distributes sugar and edible oil. The head office is located in the capital Kampala and branches are spread through 8 locations. Olam has a broad operation there, extending along the value chain from origination and processing, to logistics and distribution[25].

With the task of improving logistics, comes the Singaporean company of CrimsonLogic, a provider of eGovernment solutions. The company signed a contract with Kenya to provide a new Trade Facilitation system set to enhance the efficiency of cross-border trade at Kenyan seaports, airports and border posts. The process, implemented since May 2014, integrates systems of different government agencies into a single common platform, streamlining clearance processes for sea, air and land cargo[26].

Singapore sees Africa as the next frontier, a whole continent with enormous potential for growth and economic development. From the ASEAN nations, Singapore ranks in third place, after Thailand and Indonesia, as the biggest trading partner with Africa, having traded US$9.5 billion with the continent in 2014[27]. From those, US$ 400 million were focused in the EAC bloc[28].

Singapore’s history, from a poor estate under the British regime to one of the richest per capita countries in world, is a model of how free-market capitalism can go the right way if a solid base is built. The EAC is focusing on building this base, creating the necessary channels to make trading easier within the bloc and with external partners. This is the first step on a long journey of development and, if the leaders can keep this focus, the bloc is on the right track to become a super economic powerhouse within the next decade.

The author, Otavio Veras, is a Research Associate of the NTU-SBF Centre for African Studies, a trilateral platform for government, business and academia to promote knowledge and expertise on Africa, established by Nanyang Technological University and the Singapore Business Federation. Otavio can be reached at overas@ntu.edu.sg.

[1] Singapore’s investments in Africa hit US$16 billion (CNBC Africa, Feb 2015)

[2] East African Community website

[3] World Bank, 2014 data

[4] Transparency International

[5] Uhuru and Museveni strike deal on route for oil pipeline (The East African, Aug 2015)

[6] Tanzania becomes Kenya’s largest East Africa market (The East African, Aug 2014)

[7] Weak shilling makes Uganda Rwanda’s imports source in the region (Rwanda Eye, Jan 2016)

[8] Mombasa-Nairobi Standard Gauge Railway Project, Kenya (Railway Technology)

[9] Standard Gauge Railway means big business to local construction firms (Daily Nation, Sep 2015)

[10] Standard gauge railway construction launched (New Vision, Oct 2014)

[11] The Changing Face of Kenya’s Public Transport System (Mega Projects Kenya, Sep 2013)

[12] Kenya, U.S. firms in talks on mega $26 billion Lamu Port Southern Sudan-Ethiopia deal (Mail & Guardian Africa, Jul 2015)

[13] Kenya poised to roll out ambitious Sh2 trillion transport corridor project (Daily Nation, Jul 2011)

[14] Tanzania aims for big results with Dar es Salaam port expansion (The National, May 2015)

[15] Tanzania starts work on $10 bln port project backed by China and Oman (Reuters Africa, Oct 2015)

[16] Tanzania: Fate of Bagamoyo Port Clarified (The Citizen, Jan 2016)

[17] Tanzania: Bus Rapid Transit Spearheads Rapid Development (Tanzania Daily News, Aug 2015)

[18] Kenya: The Good, the Bad, and the Ugly of Thika Road (Daily Nation, Jan 2016)

[19] East Africa: Bids On for Construction of Kenya-Tanzania Link Road (The East African, Nov 2015)

[20] Kenya-Ethiopia power project moves notch higher (Standard Digital, Oct 2015)

[21] The Eastern Electricity Highway Project under the First Phase of the Eastern Africa Power Integration Program (World Bank)

[22] Money route opens between Kenya and Rwanda (IOL, Oct 2015)

[23] Kenya’s Java House is Expanding Across Africa. Here’s Why Competition is Good for the Market and Consumers (Ventures, Oct 2015)

[24] SCE, Surbana ink Tanzania master planning deals (The Business Times, Jan 2015)

[26] Kenya’s National Single Window System to Launch (CrimsonLogic press release, May 2014)

[27] The Big Players In Asean-Africa Trade (ASEAN Briefing, Apr 2015)

[28] International Enterprise (IE) Singapore