Collaborative effort to drive change in East Africa’s Insurance market

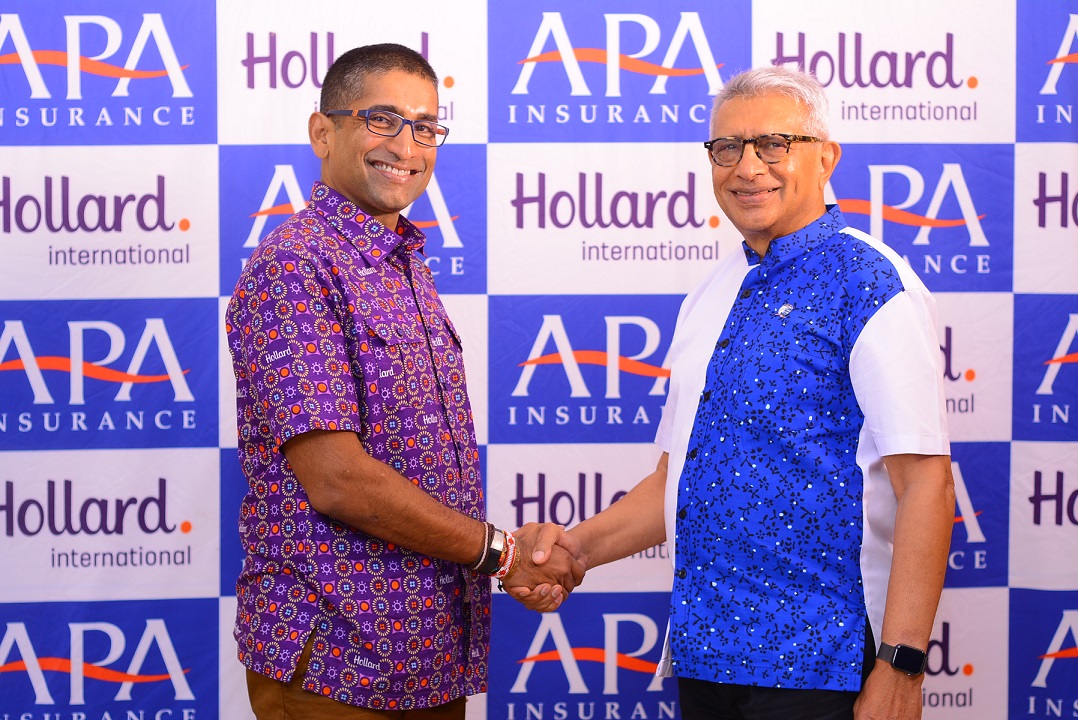

Following the announcement of their partnership last year, APA Insurance, a leading insurance company in Kenya, and Hollard International, a Pan African Insurer, have officially commenced collaborative operations. This partnership aims to unlock the potential of Kenya’s insurance industry by leveraging their combined expertise to provide customised insurance solutions for both individuals and businesses.

Ashok Shah, Group CEO of Apollo Investments Limited, said “Our partnership with Hollard International is strategic for APA Insurance as it opens new avenues for growth and expansion. Hollard’s investment in Apollo Investments Limited, APA’s parent company, provides us with access to a broader market and further expertise in insurance such as health, motor, engineering, renewable energy and marine. This collaboration not only strengthens our position in Kenya but also enhances our current operations in Uganda and Tanzania, positioning us favourably for future opportunities in the rest of Africa. Both the clients of APA and Hollard now have a network of ten African countries.”

According to Global Data Intelligence Centre, the gross written premium of the Kenya general insurance market was KES188 billion (US$1.3 billion) in 2023 and is expected to achieve a Compound Annual Growth Rate (CAGR) of more than 9% during 2024-2028.

“The partnership marks a transformative shift in Kenya and East Africa’s insurance landscape. By combining APA’s regional expertise with Hollard’s continental footprint and innovative models, we will deliver tailored insurance solutions to meet our clients’ needs. This sets a precedent for cross-regional partnerships in the African insurance industry, promoting a more integrated and competitive market,” added Shah.

PK Kalpagé, Chief Executive Officer of Hollard International, said “The regulatory environment in East Africa is very conducive to increasing insurance penetration in the region. We are excited about the operationalisation of this partnership and want to leverage our combined strengths to diversify insurance offerings and innovations while ensuring that customers receive the best value for their money.”

“Partnering with a market leading player like APA Insurance holds great strategic value, given our Pan African presence and growth strategy for Africa. Hollard, with its experience in Southern Africa and West African markets, brings valuable expertise to the table in both traditional and specialist lines of insurance,” said Kalpagé. We also see an opportunity to have significant impact on the lives of our customers in keeping with our shared value focus and our purpose of wanting to help consumers and businesses to “create and secure a better future”.

The two insurers will focus on product enhancement and diversification by launching new insurance products in core lines such as health and specialist lines such as engineering, marine and renewable energy (solar, wind, and hydro solutions), leveraging Hollard’s expertise in these areas. In addition, they will focus on risk products that can be sold through mobile network operators, given East Africa’s impressive mobile money penetration.

“Our vision for the partnership with Hollard International is to create a leading pan-African insurance entity that sets new standards in innovation, customer service and social impact. By leveraging our combined strengths, we will deliver tailored insurance solutions to meet the evolving needs of our customers across the continent. Fostering a culture of excellence, integrity and community focus, we aim to drive sustainable growth and make a meaningful difference in the lives of our clients and communities, building a resilient, inclusive and forward-thinking insurance ecosystem that contributes to Africa’s economic and social development,” concluded Shah.

APA Insurance operates in Kenya, Uganda, and Tanzania, while Hollard operates in seven additional African countries, resulting in a combined network spanning ten countries. This expansion will enhance insurance coverage and support, providing clients with convenient access to a broader range of services under one unified platform.