Residents of African countries face limitations when it comes to using their local currency outside their borders. Foreign payment systems do not accept payments in any currency other than dollars or euros. Additionally, many online stores place restrictions on the use of cards from African countries due to the high rate of fraudulent transactions on the continent. The solution to these problems for any African resident has become virtual cards, which can be issued online and used for payments wherever it’s convenient. The financial service PSTNET issues Visa virtual cards without limits on top-ups, spending, or the number of cards.

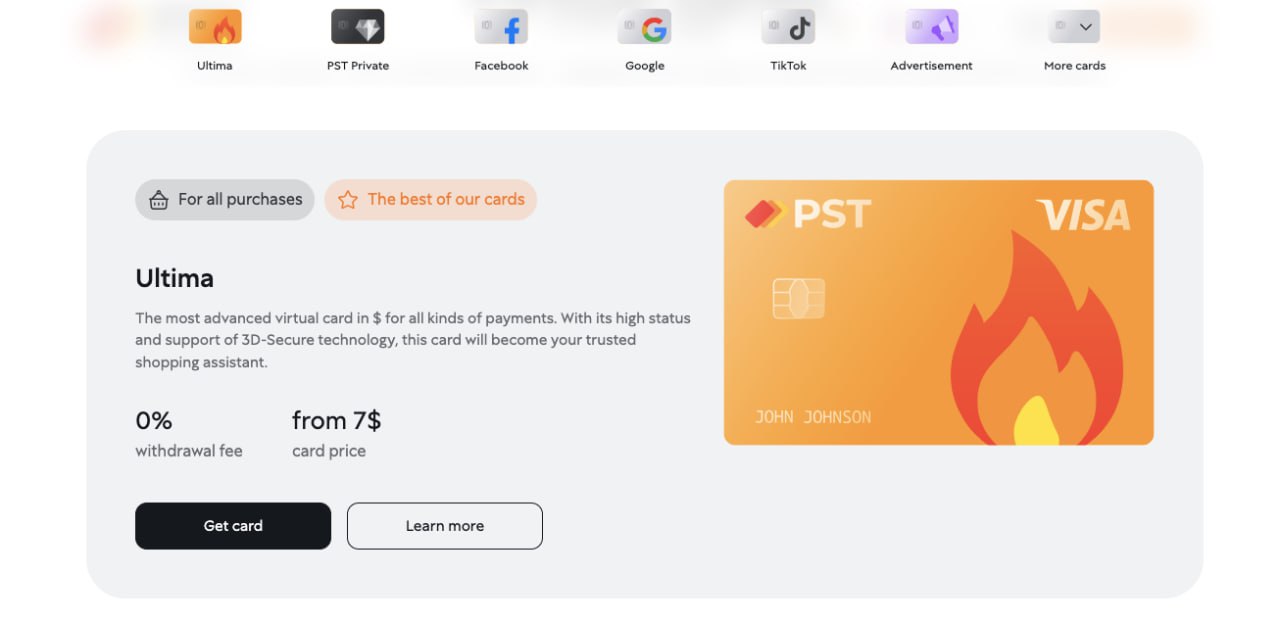

Ultima: Virtual Card Without Limits

PSTNET is known as a provider of virtual cards for online payments. Now it offers a virtual card for shopping called Ultima.

The Ultima cards are designed to facilitate international transactions and come with several advantages. Firstly, there are no fees for transactions, declined operations, or withdrawals. Secondly, the card top-up fee is just 2%. Thirdly, as mentioned earlier, there are no limits or restrictions.

The Ultima card, like all PSTNET cards, is compatible with leading payment systems such as Visa and Mastercard. This makes it suitable for payments wherever Visa cards are accepted.

PSTNET cards come equipped with all the necessary technologies to ensure secure transactions. They use the 3D Secure protocol to protect the card from fraudsters. To confirm a transaction, the user must enter a code sent via SMS or through a Telegram bot. Additionally, the service employs two-factor authentication (2FA) to protect the user’s personal data.

The Ultima card can be topped up using 18 different cryptocurrencies. Standard top-up methods are also supported — users can top up their balance via SEPA/SWIFT bank transfer and using other Visa/MasterCard cards.

The Ultima card is also ideal for converting cryptocurrency assets into fiat currency. Conversion takes place in the user’s personal account—users simply transfer funds from their crypto account to their fiat account. The entire process is fully automated.

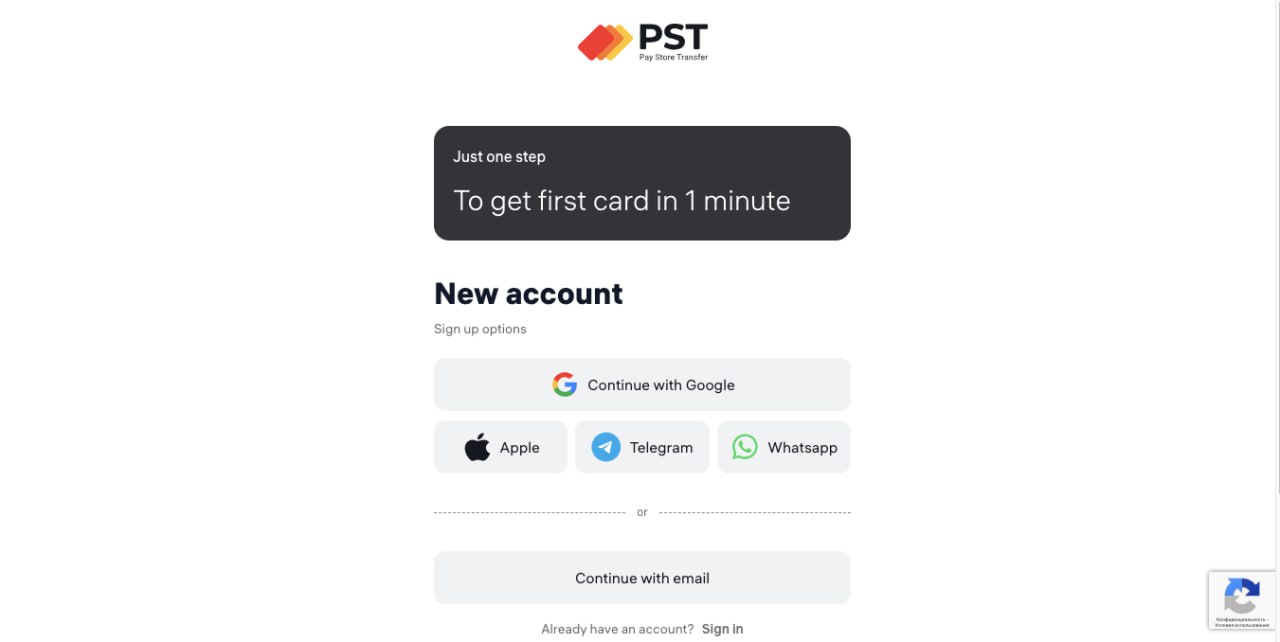

To get the Ultima card for just $7 per week, users need to sign up on the platform. This can be done using Apple ID, a Google account, Telegram, or an email address. Immediately after registration, users can begin setting up their Ultima card in their personal account—it becomes active and ready for balance top-up. No documents or user data verification are required.

Moreover, PSTNET offers virtual cards for paying for advertising. These cards are compatible with many advertising platforms and support cryptocurrency top-ups.

The service provides 24/7 customer support. Users can contact a manager and ask any questions regarding the cards at any time through Telegram chat, WhatsApp, or live chat.

48% Increase in Internet Users in Nigeria by 2027

Analysts’ forecasts show that the number of internet users in Nigeria is growing. According to Statista, by 2027, the share of internet users will increase to 48%. It’s reasonable to expect that this will also lead to an increased demand for reliable tools to pay for digital services. Virtual cards are already meeting this demand today.

PSTNET’s Visa virtual cards solve the problem of paying for foreign services for African residents. The Ultima card has no limits on top-ups or spending, supports cryptocurrencies, and costs $7 per week. It can be issued without any documents. By 2027, the number of internet users in Nigeria will grow to 48%, likely increasing the demand for such payment tools.

Source: PSTNET.