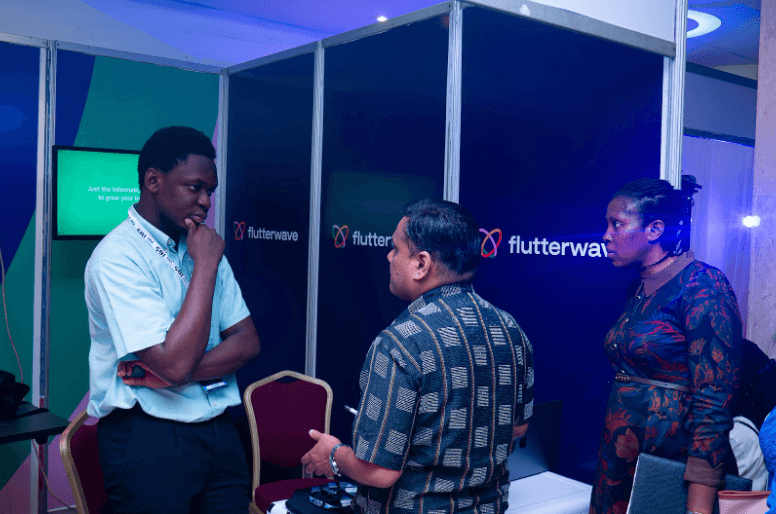

Africa Fintech Summit Announces Flutterwave as Lead Fintech Sponsor for the 10th Anniversary Summit in Lusaka, Zambia

The Africa Fintech Summit is proud to announce Flutterwave as the Lead Fintech Sponsor for its highly anticipated 10th-edition summit, set to take place in Lusaka, Zambia, on November 2-3, 2023. This partnership marks a significant milestone for both the Africa Fintech Summit and Flutterwave, showcasing their shared commitment to fostering innovation and growth within the African fintech ecosystem.

Flutterwave's dedication to advancing the fintech industry in Africa has been unwavering, making the company a natural choice as the Lead Fintech Sponsor for this landmark event. Over the years, Flutterwave has consistently demonstrated its support for the summit and the broader African fintech community, contributing to the growth of digital financial services across the continent.

The Africa...