New technology often seems fantastic on paper yet has little impact in the life of the average person. A new tipping solution for fuel pump attendants, however, does both. When asked to fill up a fuel tank as motorists do in the movies, few South Africans would know what to do beyond pulling their tank […]

Tag Archives: FinTech

By Mark Dankworth, President International at Ukheshe Technologies Mobile transacting is fast becoming the golden egg of financial services – and nowhere more so than in Africa. According to the Global System for Mobile Communications’ (GSMA) 2021 State of the Industry Report on Mobile Money, the number of registered mobile money accounts grew by 12.7% globally […]

FSD Africa, the UK Government’s flagship financial sector programme in Africa, is making an initial investment (£650,000) in a highly innovative digital solution connecting carbon credits from small-scale green projects across the global south to international buyers. The investment will deliver funding through the test phase of the solution being developed by Nick Hughes, who […]

Peach Payments is pleased to announce that it has set up an office in Mauritius recently in pursuit of its pan-African expansion strategy. As a FinTech start-up that was set up in South Africa in 2012 and expanded into Kenya in 2018, the company is set to make a significant contribution to the pan-African FinTech landscape […]

This new publication explores the answers to the question: How best to digitalise a financial institution? The case study draws upon management consulting literature to assess digitalisation strategies in a pragmatic way. It assesses three leading African financial organisations against this framework: Al Barid Bank, Morocco; Equity Bank, Kenya; and Consolidated Bank, Ghana. The World […]

Incumbent banks are starting to look to “platform banking” to stay relevant and loved by customers. But what is platform banking in the first place? And why is it a good thing for society? Anthony de Gray Birch, co-founder and Chief Operating Officer (COO) of Direct Transact, South Africa’s biggest banking enabler of the past […]

Leading South African founded and owned Agri-FinTech start-up HelloChoice has announced the finalisation of a major investment from Standard Bank, solidifying its market leading position as the premiere digital fresh produce and agricultural marketplace. HelloChoice is a proudly South African success story, founded in 2018 by Grant Jacobs and Graeme Jarvie, who had a vision to […]

Africa’s leading banks including EcoBank, Nedbank, Attijariwafa Bank, United Bank of Africa, Co-operative Bank of Kenya and Banco Mais are tapping into IBM technologies to help advance financial inclusion across the continent IBM today announced that major financial institutions across Africa have selected hybrid cloud and AI capabilities from IBM to unlock digital innovation and continue […]

SOL unveils virtual card and new brand as it redefines the customer experience SOLmate, an online payment platform that offers clients a digital wallet facility, has unveiled an exciting new product offering together with an extensive rebrand and renewed corporate vision. Following a name change to SOLmate, the fintech has launched a new, innovative virtual card […]

From Financial Access – to Financial Health By Sakhile Mabena, CEO, OFIN, a fintech startup specialising in Behavioural Data Analytics, Financial Process Automation, Behaviour-based Financing and SME Behaviour Nudges There is currently a revolution in the space of financial inclusion, with around 70% of people worldwide now having access to financial services, up from just […]

On the back of Cape Town being recognised as the tech capital of Africa, topping international rankings for foreign direct investment strategy, Ian Lessem, Managing Partner at HAVAÍC – investors in early-stage, high-growth technology businesses – says several other African cities are quickly emerging as leading startup and investment hubs to watch. “Startups in Nigeria, Kenya, Egypt and South Africa […]

In 2020, e-commerce in South Africa spiked by 66%, driven by COVID-19-induced lockdowns and a drop in brick-and-mortar retail sales[i]. This increase was accompanied by an upsurge in the use of instant Electronic Funds Transfer (EFT) payments. Towards the end of last year however, the SA Reserve Bank, Payment Association of South Africa (PASA), and […]

The global pandemic has ushered in a new paradigm for the Retail Banking sector, one which demands quicker transformation to a customer-centric service that is digitised, personal and convenient. A recent Financial Industries panel discussion held by Kearney, a global consultancy, shed light on how the power of data, Application Programming Interfaces (APIs) and automation […]

A survey by Statista found that around 32 percent of people in Nigeria use cryptocurrencies and this is the highest proportion of a population in the world. In terms of trade volume, the country stands in 3rd position after the United States of American and Russia with a transaction value of more than 400 million […]

Connected Asset Financing Platform Commercially Launching After 20,000 Device Pilot 12th July 2021. Lagos, Nigeria. M-KOPA, the leading connected asset financing platform, today announces it has officially expanded to Nigeria. To lead the Nigeria team, M-KOPA has named Babajide Duroshola as the new General Manager. A part of the tech company’s broader expansion strategy, the […]

Bushra Mahdi is appointed as the brand ambassador for Tetra Pay International INC for the countries in the GCC and the MENA alliance of nations. Leading Instagram influencer, Bushra has over 299 thousand followers on her Instagram page making her a youth icon. She is also the founder of Red Films, owing to her passion […]

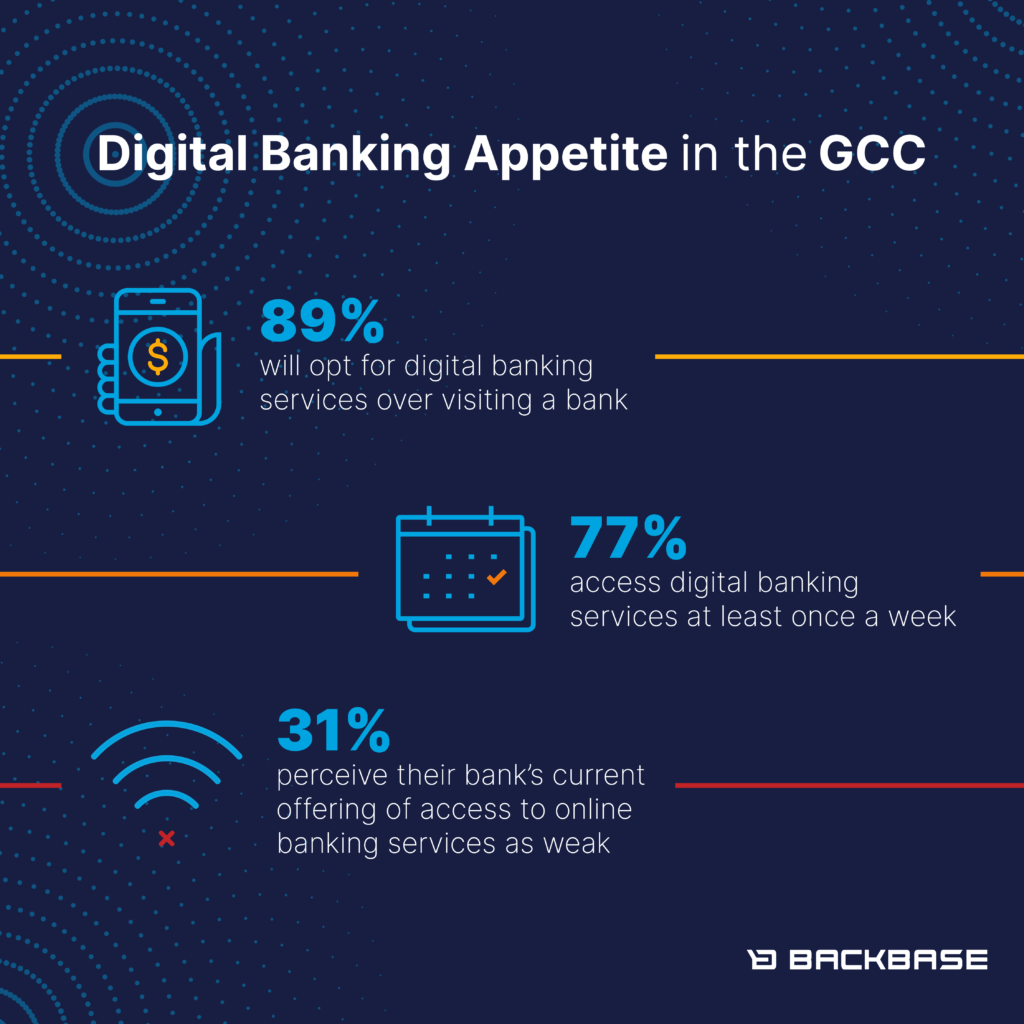

77% of respondents in the GCC access digital banking services at least once a week 44% are willing to switch to a different bank due to poor customer relations 31% perceive their bank’s current offering of access to online banking services as weak Consumer appetite for digital banking services continues to grow in the countries […]

VerPay enables verbal commerce as businesses adapt to serve their customers in contactless ways As South Africa enters its third wave and lockdown restrictions tighten, certain businesses – such as those in hospitality – once again find themselves having to temporarily close their doors, while seeking alternative avenues to generate income, such as take-aways. “The […]

Gone are the days when the financial institutions’ (FI) only assets considered to be the gold, cash and other valuables in its vaults. With data widely acknowledged as the new gold, ensuring that only legitimate people get access into the FI’s premises and digital databases is more important than ever By: Nicolas Garcia, VP MEA, […]

It is a common belief that financial access should lead to financial prosperity. According to the World Bank, financial inclusion is defined as all people and businesses having access to useful and affordable financial products and services that meet their needs. Sakhile Mabena, CEO, Ofin, a venture-backed fintech startup specialising in Behavioural Data Analytics, Financial Process […]

As the second half of 2021 approaches and Covid-19 vaccinations roll out across the globe, albeit at varying rates, Ian Lessem, Managing Partner at HAVAÍC, investors in early-stage, high-growth technology businesses, considers the trends making an impact on the African Venture Capital (VC) landscape. Homegrown solutions take on the world At HAVAÍC, our investment thesis is […]

The call for applications is open to any startup based in Mauritania, Morocco, Algeria, Tunisia or Libya that has been operating for over 18 months in one of the following areas: e-health, climate, mobility, agritech, social economy and financial inclusion. As a result of the work done during the preparatory forums for the Summit of […]