Yomi Kazeem, Engagement Manager at Salient Advisory, and his colleagues explore the alarming trend of declining investments in African healthtech.

In 2023, amid a nearly 40% slump in investment across African technology ecosystems, funding for healthtech startups across the continent proved resilient, dropping by only 2% – but that is set to change.

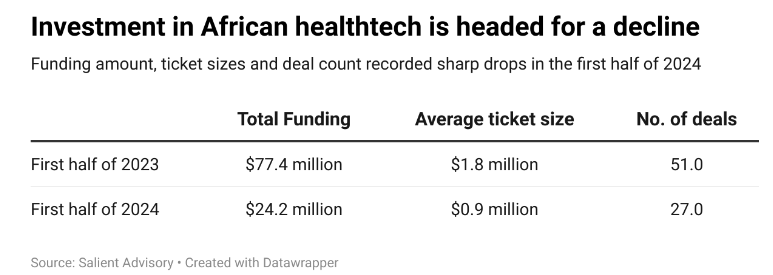

Analysis of funding trends in the first of half of 2024 suggests that a major decline in healthtech investment is on the cards, with African healthtech innovations raising only $24 million – a 69% drop compared to the same period in 2023, according to data from Salient Advisory.

The drop in funding is driven by a decline in both deal count and value: the number of deals is down by 47% in the first half of 2024, and the average ticket size has dropped by 50%. Having raised only $24 million so far, African healthtech startups need to raise nearly 500% more in the second half of the year just to match last year’s total investment of $167 million.

Counting the costs

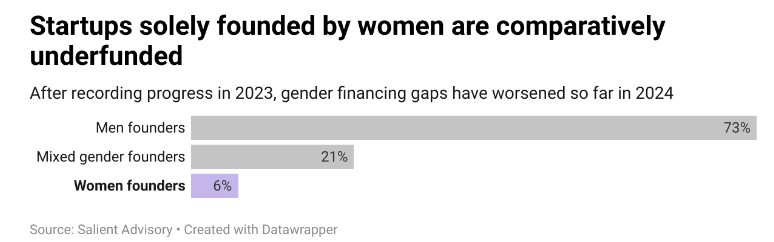

As Salient Advisory’s analysis of funding trends in African healthtech showed last year, historical gender financing gaps were significantly narrowed as companies founded by women accounted for 31% of the total funding raised in 2023 – up from 1.4% in the previous year.

However, analysis of 2024 data so far suggests that the progress in narrowing gender financing gaps will likely prove to be the exception, rather than the new norm: women founders in healthtech secured only 6% of total investment in the first half of 2024. Only three companies solely founded by women – MobiHealth (Nigeria), RecoMed (South Africa) and PharmaRun (Nigeria) – secured funding in the first half of 2024, marking a 67% decline from the same period in 2023.

The drop in overall funding is also reflected in declines in the value of equity and grant investments (both down by over 70%). Equity funding, historically the most common funding type for startups, is down by 73%, while grant funding is down by 78%. Nonetheless, equity investments account for 85% of funding received by innovators in the first half of 2024. Egyptian online pharmacy, Yodawy’s $10 million equity investment from Ezdehar stands out as the largest individual equity deal.

Grants account for only 1% of investment received in the first half of the year, at just over $300,000. Nigerian-based maternal health startup, HelpMum Africa, accounts for nearly 70% of grant funding received, having been awarded a $225,000 grant by the African Visionary Fund.

In contrast, the deal count and value for debt-based funding – historically the rarest funding source – is up: after recording no such deal in the first half of 2023, one debt-based investment was recorded in the first half of 2024. Ilara Health, a Kenya-based startup enabling private clinics to access diagnostic devices and pharmaceutical products, raised $1.7M in debt funding as part of a Series A equity-debt investment deal.

Notably, there have also been no late growth-stage funding deals i.e. Series B or higher rounds, which are typically higher and significantly impact overall funding. Last year, for instance, four Series B deals accounted for 52% of all funding in African healthtech.

Trends on repeat

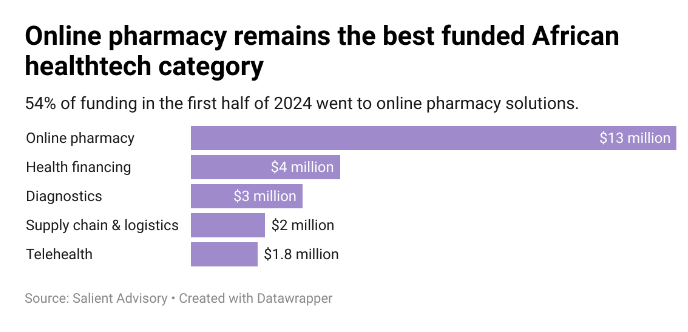

Online pharmacies received 54% ($13.1 million) of all funding raised across all healthtech categories in the first half of 2024, keeping in line with funding trends from last year when online pharmacies were the best-funded healthtech category. Egyptian online pharmacy and pharmacy benefits management startup Yodawy ($10 million) and Côte d’Ivoire-based Lapaire ($3 million) accounted for nearly all the funding.

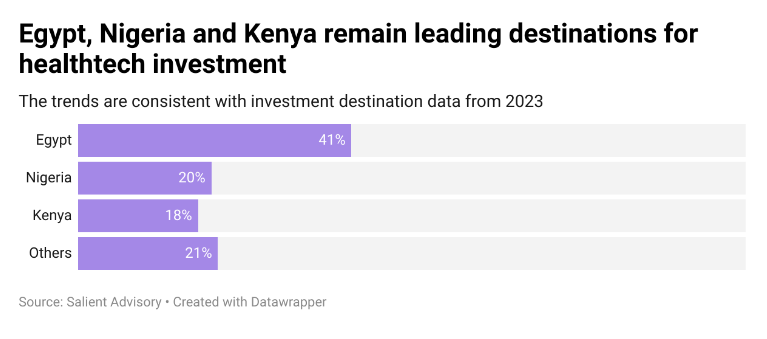

Egypt, Nigeria and Kenya also remain the top healthtech investment destinations in the first half of 2024 with startups in these countries receiving 79% of the total funding. Egypt alone accounted for 41% of the funding raised in the first half of the year, driven by Yodawy’s $10 million round. While not featuring as a top investment destination, South Africa stands out in terms of deal count, with the joint highest number of investment deals, alongside Egypt. However, with an average ticket size of $74,000, South Africa accounts for only 1% of all funding received.

Stemming the decline

The decline in funding for African healthtech startups is not happening in a vacuum – it reflects broader trends in African tech ecosystems with investments down by 50% in the first half of 2024, compared to the same period last year.

However, to stem the decline in African healthtech investments, Africa-focused investors and donors will need to significantly ramp up activity in the rest of the year. Deliberate and intentional strategies to back promising healthtech startups are required to provide them with crucial early and growth-stage funding to test their models and scale their solutions. Similar intentionality is required to fund women-founded startups and shore up widening gender financing gaps.

As it turns out, there is growing, compelling evidence to fund healthtech startups. As Salient’s recent research shows, standout healthtech startups on the continent are maturing rapidly, evidenced by their multi-country operations and their growing scale, reaching thousands of health facilities and millions of consumers directly through a range of solutions. For instance, Kasha, an East Africa-based health access startup reported over $50 million in annual revenues for 2023.

While the resilience seen in African healthtech last year appears unlikely to be repeated barring a 500% spike in funding in the latter half of the year, some respite could come from impending donor-funded support programs focused on African healthtech startups. Investing in Innovation – a $7 million pan-African initiative providing early and growth-stage companies with grants & access to markets support – is a key example. After supporting 60 startups over the past two years, the program is set to launch its second phase later this year, committing up to $225,000 in individual grants to its next cohort of growth-stage African healthtech startups.

About Yomi Kazeem

Yomi leads Salient’s market intelligence on African health tech, tracking companies’ growth and impact, spotting trends and advising global clients. Prior to joining Salient he worked as a reporter for Quartz Media, a New York-based business news outlet and led the publication’s coverage of African startups as well as consistently produced insightful pieces on the biggest trends across the continent’s tech and innovation ecosystems. With an interest in helping audiences understand the dynamics of African tech and startup ecosystems, he has 5+ years experience of journalism. He was shortlisted for the Michael Elliot Awards for Excellence in African Storytelling in 2019.

About Zillah Waminaje

Zillah works with the market intelligence team at Salient Advisory to provide insights on African healthtech ecosystems. Prior to this, she managed and supported the design and implementation of various digital health initiatives and solutions for sexual and reproductive health, health information management, and public health emergency management programs. She has a Master’s Degree in Public Health.

About Joshua Uka

Joshua leads Salient Advisory’s work in digital health infrastructure assessment and supports e-pharmacy regulators across Africa. Joshua has over 8 years of experience in the field of strategy and management consulting. Joshua formerly worked at PwC, where he delivered projects across various industries such as energy, healthcare, financial services, technology, and the public sector. His work included, among other things, market entry advice, cost optimization, establishment of public policies, and planning and management. Joshua is a certified health and safety professional from the National Examination Board in Occupational Health and Safety (NEBOSH) and is a Certified risk manager from the Institute of Risk Management. He also graduated from Babcock University with a degree in public health.