The global pandemic has ushered in a new paradigm for the Retail Banking sector, one which demands quicker transformation to a customer-centric service that is […]

Category: Fintech

Fintech Africa

South Africa. Banking customers are urged to remain extra vigilant during these trying times

South Africa is in the middle of one of the most tyring times in the country’s history. Unemployment was on the rise which will only […]

Top 5 Reasons Why Nigerian Pioneer Bitcoin Remittances

A survey by Statista found that around 32 percent of people in Nigeria use cryptocurrencies and this is the highest proportion of a population in […]

M-KOPA Expands to Nigeria, Appoints Babajide Duroshola as New Country General Manager

Connected Asset Financing Platform Commercially Launching After 20,000 Device Pilot 12th July 2021. Lagos, Nigeria. M-KOPA, the leading connected asset financing platform, today announces it […]

Bushra Mahdi appointed as the Brand Ambassador for Tetra Pay International in the GCC and MENA region

Bushra Mahdi is appointed as the brand ambassador for Tetra Pay International INC for the countries in the GCC and the MENA alliance of nations. […]

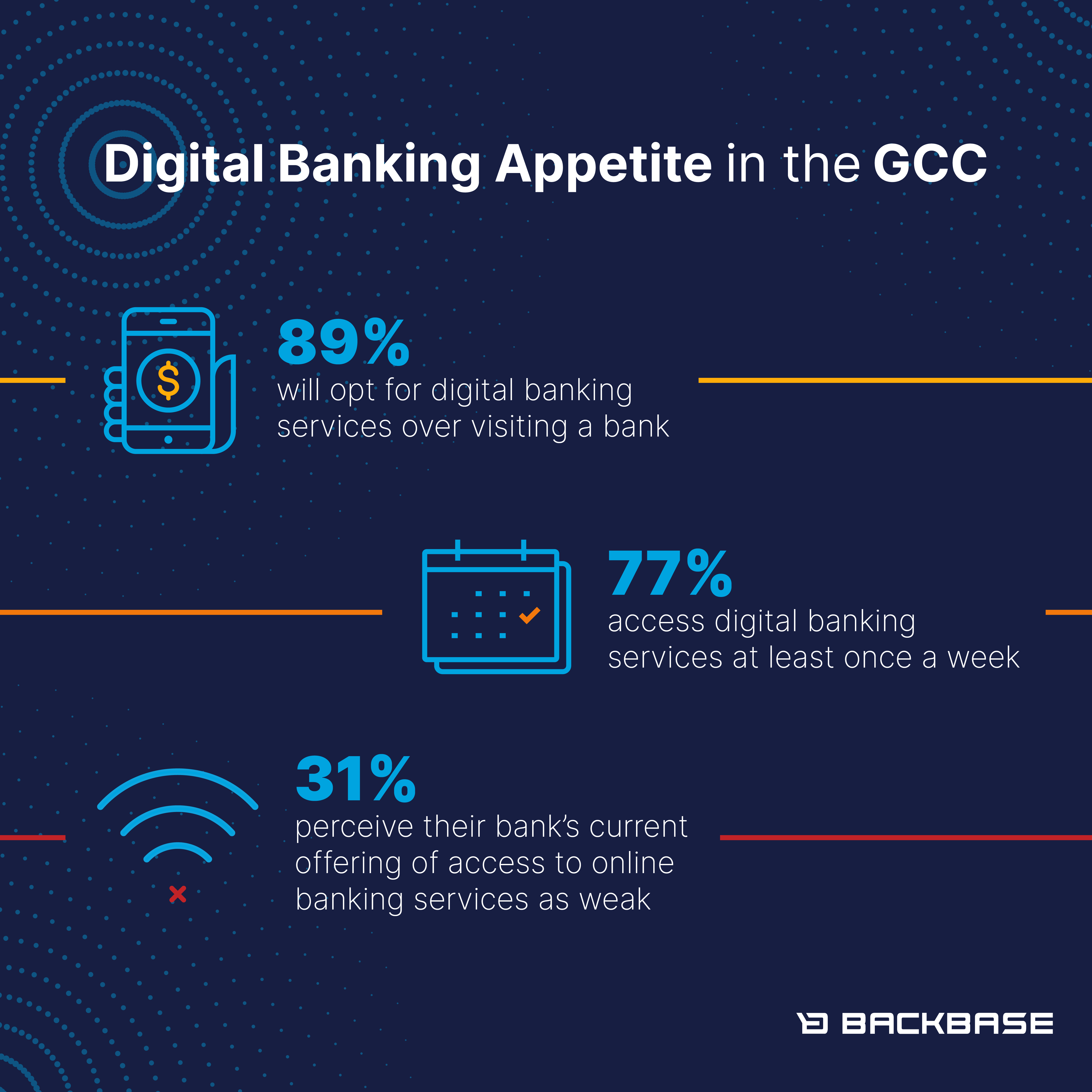

89% of GCC consumers will opt for digital banking services over visiting a physical branch post Covid-19

77% of respondents in the GCC access digital banking services at least once a week 44% are willing to switch to a different bank due […]

Telephonic payment solution helps companies deal with Covid-19 challenges

VerPay enables verbal commerce as businesses adapt to serve their customers in contactless ways As South Africa enters its third wave and lockdown restrictions tighten, […]

Should You Still Buy Bitcoin at $35,000?

The bitcoin market has been on a downward trend over the last month. Bitcoin has dropped almost 50% from its all-time high of 46 lakhs […]

BEC Attacks: Who is legally responsible?

Business Email Compromise (BEC) and cyber attacks are on the increase worldwide. Conveyancing firms, their clients, and other organisations effecting many large non-recurring type transactions […]

Telecel Group ASIP Accelerator powered by Startupbootcamp AfriTech selects Top 10 startups for 2021 Cohort

Telecel Group Africa Startup Initiative Program (ASIP), with Africa’s top early-stage tech Accelerator, Startupbootcamp Afritech, has selected the 10 tech startups that will participate in […]