Scan to Pay, powered by Ukheshe, is the largest QR ecosystem in South Africa and is used by more than 600,000 vendors, 14 banks and fintech companies and 94 payment service providers. Now, this new partnership will seamlessly introduce more crypto payment options to mainstream South Africa through the Scan to Pay app.

Category: Fintech

Fintech Africa

Digital wallets as an enabler for financial services in Africa

The recent GSMA 2023 State of the Industry Report on Mobile Money highlights how mobile money has become a mainstream financial tool in many African countries.

The gender financial inclusion gap in Africa

While financial inclusion is growing in importance worldwide there is still a discrepancy between male and female financial inclusion – the so-called gender financial inclusion gap.

9 Ventures Announced for the Africa Money and DeFi Summit Investment Showcase

The Africa Money and DeFi Summit has announced nine ventures selected to showcase their cutting-edge Web3, Blockchain, Fintech, and Decentralised Finance (DeFi) businesses to investors and industry leaders, live on stage, in Accra, Ghana on October 3rd and 4th.

The power of tech sales: Bridging the digital transformation gap

In today’s fast-evolving world of technology, the role of the tech sales professional is critical in bridging the gap between companies looking to move with the times and effect a digital transformation of operations, and those with the expertise to assist them.

Harnessing the power of data to drive financial and economic inclusion

Data analytics can facilitate economic and financial inclusivity in Africa by tailoring fintech solutions to meet the specific needs of communities, as exemplified by Mukuru.

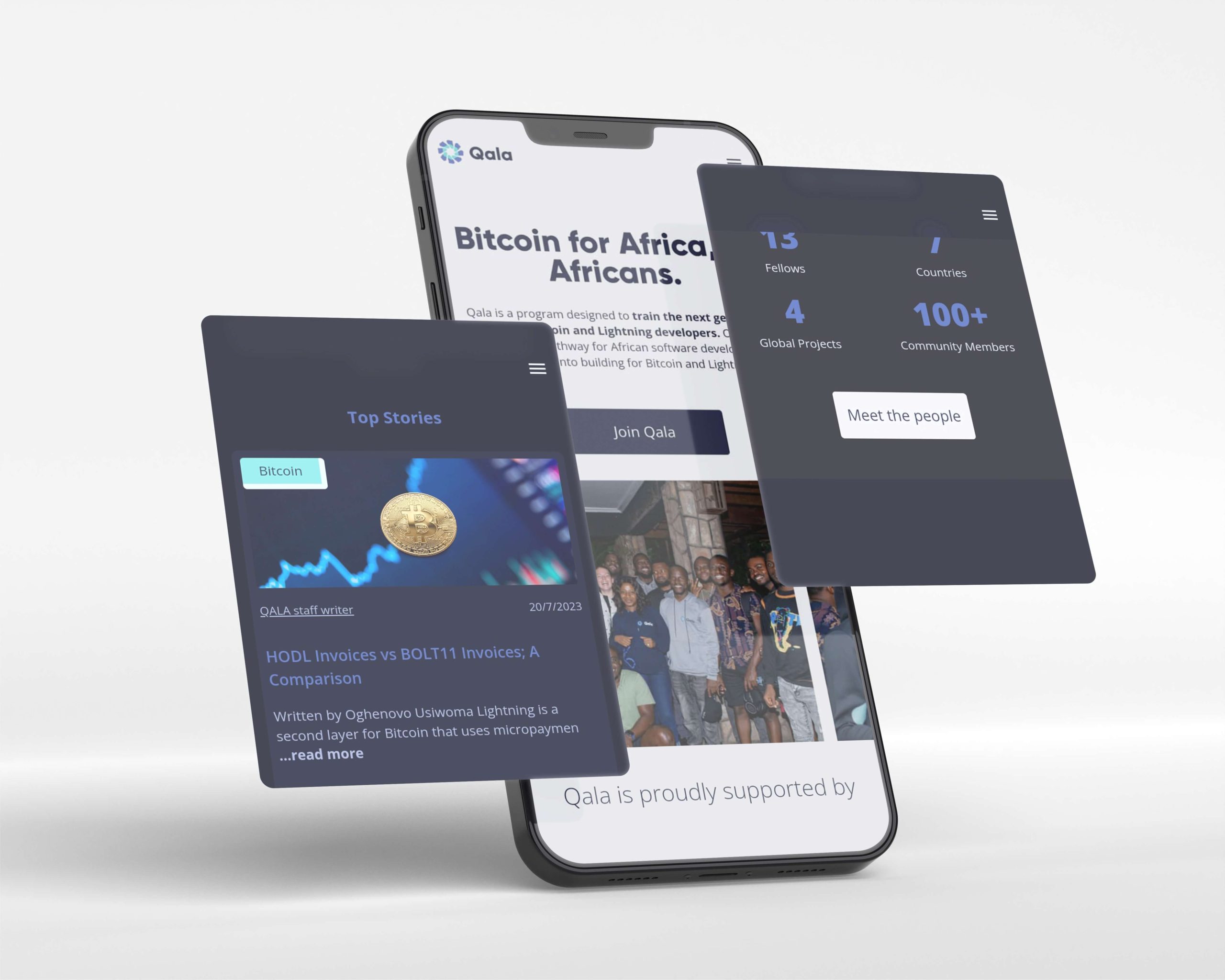

₿trust Acquires African Bitcoin Developer Training Company, Qala

Jay-Z and Jack Dorsey-funded Bitcoin Non-profit Acquires Qala to Build Next Generation of Open-Source Bitcoin Developers

Over 200 Leading African and Global Organizations Set to Convene at Africa Fintech Summit Lusaka, Zambia, this November

The stage is set for the largest gathering of fintech stakeholders from around Africa and the globe as the Africa Fintech Summit prepares for its […]

Cultivating a frictionless payment experience for merchant success

Wesley Fetter, Product Manager at Ecentric Payment Systems explains how cultivating a frictionless payment experience is key for merchant success.

Why an African-based, African-run payments partner with global insights is essential for success on the continent

The article delves into the dynamics of Africa’s payment ecosystem, highlighting the unique challenges faced in the continent, particularly in the Democratic Republic of the Congo (DRC).