According to Euromonitor, the world’s fastest-growing economies by 2030 will be in Africa. This consequently makes the continent the next big e-commerce market. And as […]

Category: Tech

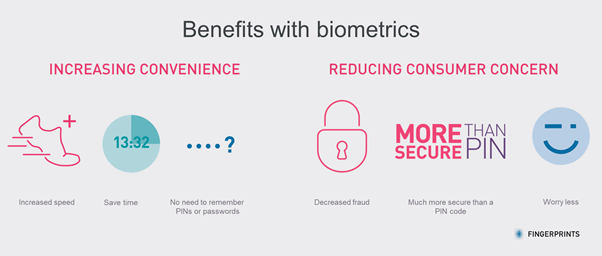

The Human Touch: Biometrics Yesterday, Today and Tomorrow

By Christian Fredrikson, CEO, Fingerprints For thousands of years, humanity has used fingers to express itself. Crossing one’s index and middle fingers in the West […]

Biometric payments – forget sensor size, focus on performance

By Jonas Nilsson, Product Manager at Fingerprints Biometric authentication has come a long way in recent years. Launched in the first Android smartphone almost five […]

Can e-commerce be Africa’s economic goldmine?

Digital economy in Africa is snowballing, and in the process it’s creating new jobs and opportunities for digital entrepreneurs to explore a larger web market. […]

How new sensor technology opens up for smarter presence detection

By Anders Jansson CTO, JonDeTech New sensor technology can bring about new and more efficient presence detection in, for example, the construction and real estate […]

Friday@Noon on Financial Services in Africa: 2018

by Johan Burger The NTU-SBF Centre for African Studies publishes a weekly newsletter on issues relevant to Africa. This paper is based on issues addressed […]

Friday@Noon on E-commerce in Africa: 2018

by Johan Burger The NTU-SBF Centre for African Studies publishes a weekly newsletter on issues relevant to Africa. This paper is based on issues addressed […]

Online Marketplaces Could Create 3 Million Jobs in Africa by 2025

Online marketplaces such as Jumia, Souq, Uber, and Travelstart could create around 3 million new jobs by 2025 across Africa. These digital platforms, which match […]

Quantum, AI turns computing into a ‘loaded gun’

Biggest-ever DevConf opens with warning on ethics in new world of computing Quantum computing and AI and machine learning are dramatically changing the face of […]

The future of cards, contactless and biometrics in payments

By Thomas Rex, SVP at Fingerprints It’s an interesting time for the humble payment card. Card payments have steadily risen in the last two decades, […]