P1 Ventures supports startup launching efficient currency exchange platform using stablecoin technology, enabling individuals and businesses to fully engage in the global economy.

Tag: African fintech

Digitisation as Africa’s Great Equaliser in Financial Services

Access to financial services in Africa had for decades been defined by disparities—between rural and urban areas, between men and women, between small businesses and larger enterprises. It meant that millions, especially the continent’s most vulnerable populations, were excluded from the formal economy, curbing entrepreneurship, restricting access to credit, and stifling upward financial mobility for far too long.

THE RISE OF FINTECH INNOVATION IN SA: GOING BEYOND PAYMENTS TO TRANSFORM ACCESS AND OPPORTUNITIES FOR STARTUPS

The piece, “The Rise of Fintech Innovation in SA: Going Beyond Payments to Transform Access and Opportunities for Startups,” discusses how fintech solutions have revolutionized how these businesses operate, providing access to affordable financial services, business management tools, and support.

This article offers valuable insights into the growing fintech ecosystem in South Africa and its potential to drive economic growth.

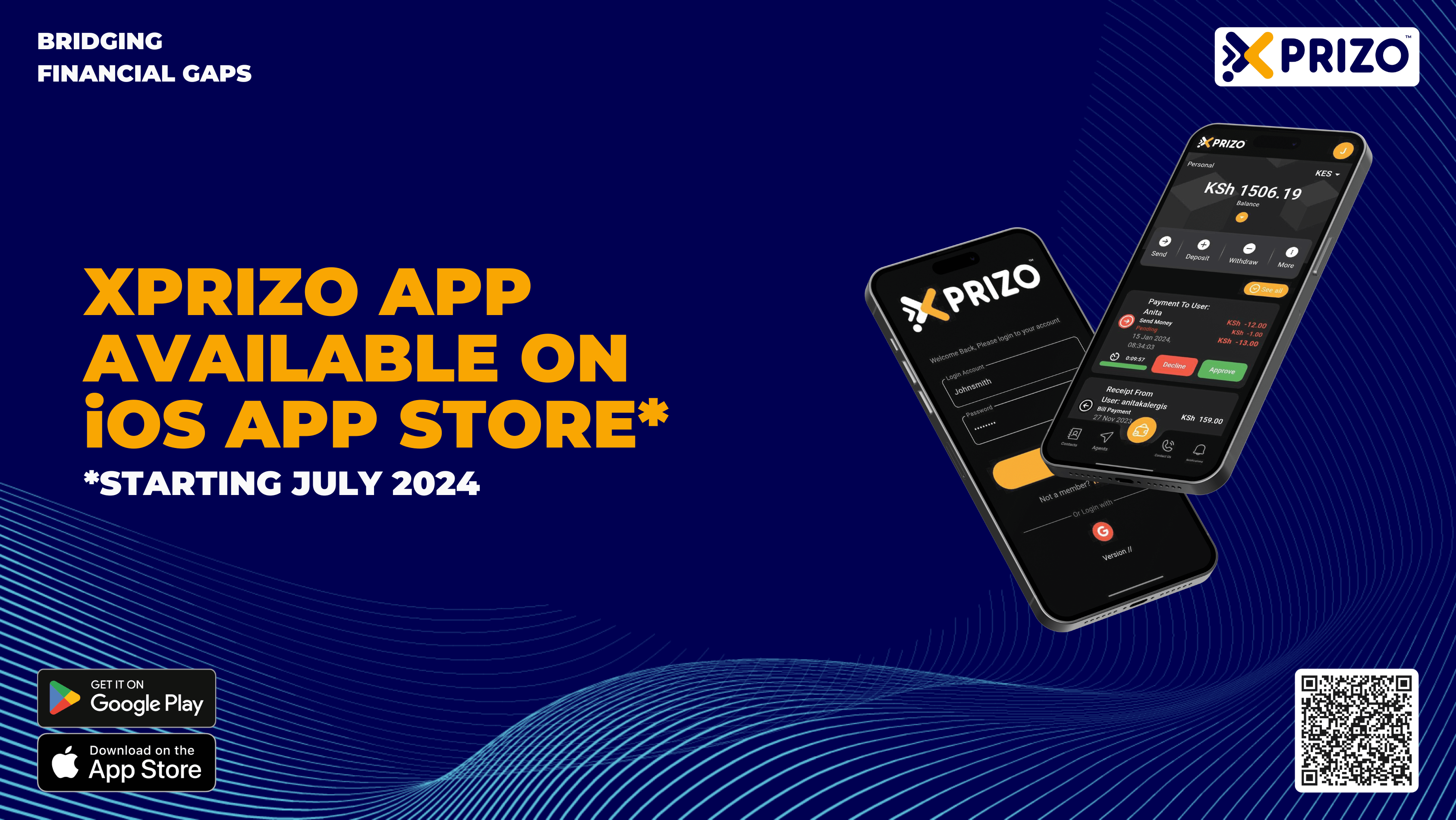

Xprizo enhances fintech platform with iOS launch

Xprizo, a cutting-edge iGaming fintech platform, has amplified its global reach with the launch of its iOS app. This marks a significant milestone in the company’s growth and development as a fintech platform serving the underbanked and unbanked demographics.

Africa Fintech Summit Rolls Out Nigeria Fintech Marketing Outlook 2024, Featuring Trends, Perspectives, Growth Strategies, and More

The Africa Fintech Summit (AFTS) releases its insightful “Nigeria Fintech Marketing Outlook 2024” report, shedding light on the current state and future direction of marketing strategies within the nation’s booming fintech industry.

Tough economic headwinds provide exciting opportunities for agile, customer-centric fintechs

By offering personalised experiences and innovative solutions, fintechs can navigate the evolving tech and business landscape, transforming the way money is stored, used, and moved in South Africa. Amid challenging economic headwinds, South African fintechs have the potential to excel by prioritising customer-centric approaches and strategic partnerships, while embracing digitisation and regulatory changes. Andy Jury, CEO of Mukuru shares insights into the fintech trends for 2024, while looking at where we are now.

9th Edition Connected Banking Summit – West Africa Innovation & Excellences Awards 2024

Accra, Ghana Get ready to mark your calendars as the 9th Edition of the Connected Banking Summit- West Africa is set to take Accra, Ghana on February 21st, 2024.

Why an African-based, African-run payments partner with global insights is essential for success on the continent

The article delves into the dynamics of Africa’s payment ecosystem, highlighting the unique challenges faced in the continent, particularly in the Democratic Republic of the Congo (DRC).

Blockchain Africa Conference 2023: Gearing African businesses to compete in the global marketplace

The adoption of blockchain technology has gained traction in South Africa, Kenya, Nigeria and Ghana – resulting in more efficient and lower-cost cross-border payments to […]

Blockchain to rebuild African financial system and tell new story

Blockchain Research Institute Africa Making Strides in Levelling Financial Playing field Africa has an enormous cash and informal trade economy, however, at the root of […]