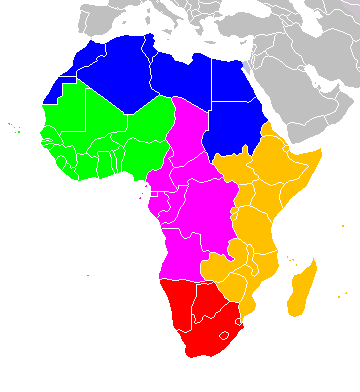

Dealmaking activity in sub-Saharan Africa (SSA) dropped in the second half of 2020 (H2 2020), when compared to the second half of 2019 (H2 2019) […]

Tag: Baker McKenzie

Commitment to sustainability opening doors to post-pandemic capital in Africa

By Wildu du Plessis, Head of Africa, Baker McKenzie The industrials, manufacturing and transport (IMT) sector is being hit hard by COVID-19 disruption, but commitment […]

The impact of COVID-19 on finance and investment in Africa

By Morne van der Merwe, Managing Partner, and Wildu du Plessis, Head of Africa, Baker McKenzie Johannesburg The Coronavirus (COVID-19) has resulted in mass production […]

Investing in Africa: An Outlook on Nigeria and Ethiopia

Itumeleng Mukhovha, an associate in the Corporate/M&A practice at Baker McKenzie in Johannesburg One can easily assume that international investors are deterred from investing in […]