If you are like any normal South Africa, you approach intersections labelled high crime or high smash and grab zone with an overabundance of caution and the same applies […]

Tag: banks

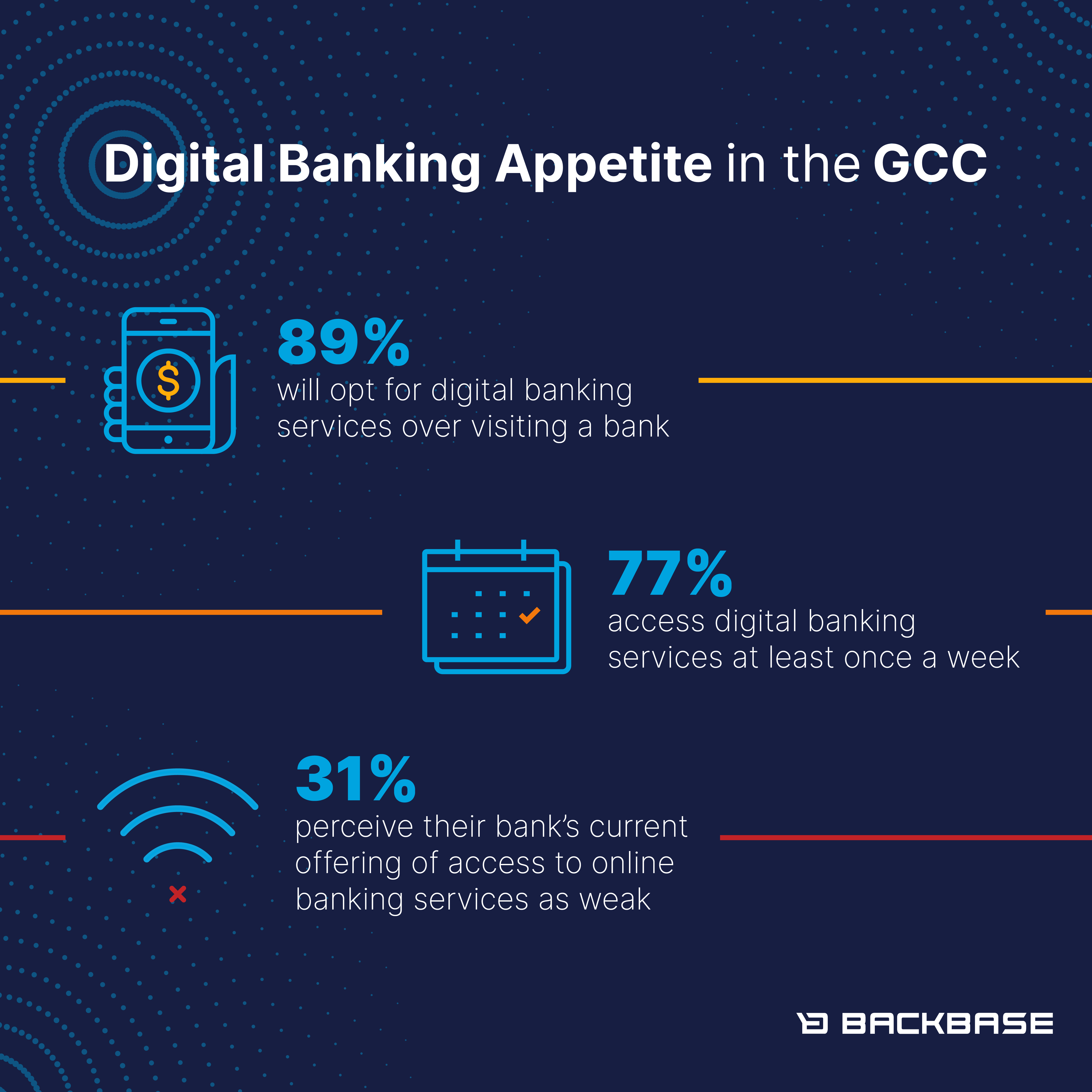

89% of GCC consumers will opt for digital banking services over visiting a physical branch post Covid-19

77% of respondents in the GCC access digital banking services at least once a week 44% are willing to switch to a different bank due […]

Friday@Noon on Financial Services in Africa: 2018

by Johan Burger The NTU-SBF Centre for African Studies publishes a weekly newsletter on issues relevant to Africa. This paper is based on issues addressed […]

African Banking innovation sees AfDB approving multi-currency line of credit of USD 300m

By Thandisizwe Mgudlwa The African Development Bank has extended the equivalent of USD 300 million to FirstRand Bank Limited to support projects across Africa This […]

JinkoSolar to Supply 81 MW WBHO-Building Energy in South Africa

SHANGHAI, Dec. 12, 2012 /PRNewswire-FirstCall/ — JinkoSolar Holding Co., Ltd. (“JinkoSolar” or the “Company”) (NYSE: JKS), a leading global solar power product manufacturer, today announced that […]

The 10th Forex Conference & Expo Kicks off this Thursday 15 November in Dubai

The show will open its doors in Dubai at 10:00 am on Thursday and will cover online trading currencies, commodities, gold, oil, stocks and […]

Standard Bank Group commits R9.4bn to first batch of renewable energy projects

Standard Bank Group has emerged as the leading investor in the first round of South Africa’s renewable energy independent power producer (REIPP) procurement process, backing […]

High-level Seychelles delegation and ProgressSoft at Connected World Forum

after nationwide mobile money launch 1000+ mobile lifeline experts gather in Dubai this month The global payment solutions giant ProgressSoft will share details of the […]

Serving up a POWER-GEN-sized slice of colossal Kusile

As part of the inaugural POWER-GEN Africa, taking place at the Sandton Convention Centre from 6-8 November, an intrepid group of delegates had a […]

Bunna International Bank Partners With Finacle From Infosys for Banking Transformation

ADDIS ABABA, Ethiopia and BANGALORE, India, November 1, 2012/PRNewswire-FirstCall via African Press Organization (APO)/ — New Core Banking Solution to Improve Customer Service and […]