Africa’s leading neobank’s expansion into Rwanda aims at making digital banking accessible to all remote workers & professionals on the continent while ensuring access to […]

Tag: digital banking

Big Fintech Company “Opportunities” for Small Businesses or Mousetrap for Your Money

This small post contains unpleasant moments from Fintech companies that small companies or entrepreneurs face. Best Online money transfer, Best Digital payment services… = High […]

Africa is leading the way in mobile money, and it will change banking as we know it

By Mark Dankworth, President International at Ukheshe Technologies Mobile transacting is fast becoming the golden egg of financial services – and nowhere more so than […]

PLATFORM BANKING AND OPEN BANKING: why it’s the next big thing for banks and their customers

Incumbent banks are starting to look to “platform banking” to stay relevant and loved by customers. But what is platform banking in the first place? […]

Banks across Africa Turn to IBM Hybrid Cloud and AI Solutions to Accelerate Digital Innovation

Africa’s leading banks including EcoBank, Nedbank, Attijariwafa Bank, United Bank of Africa, Co-operative Bank of Kenya and Banco Mais are tapping into IBM technologies to […]

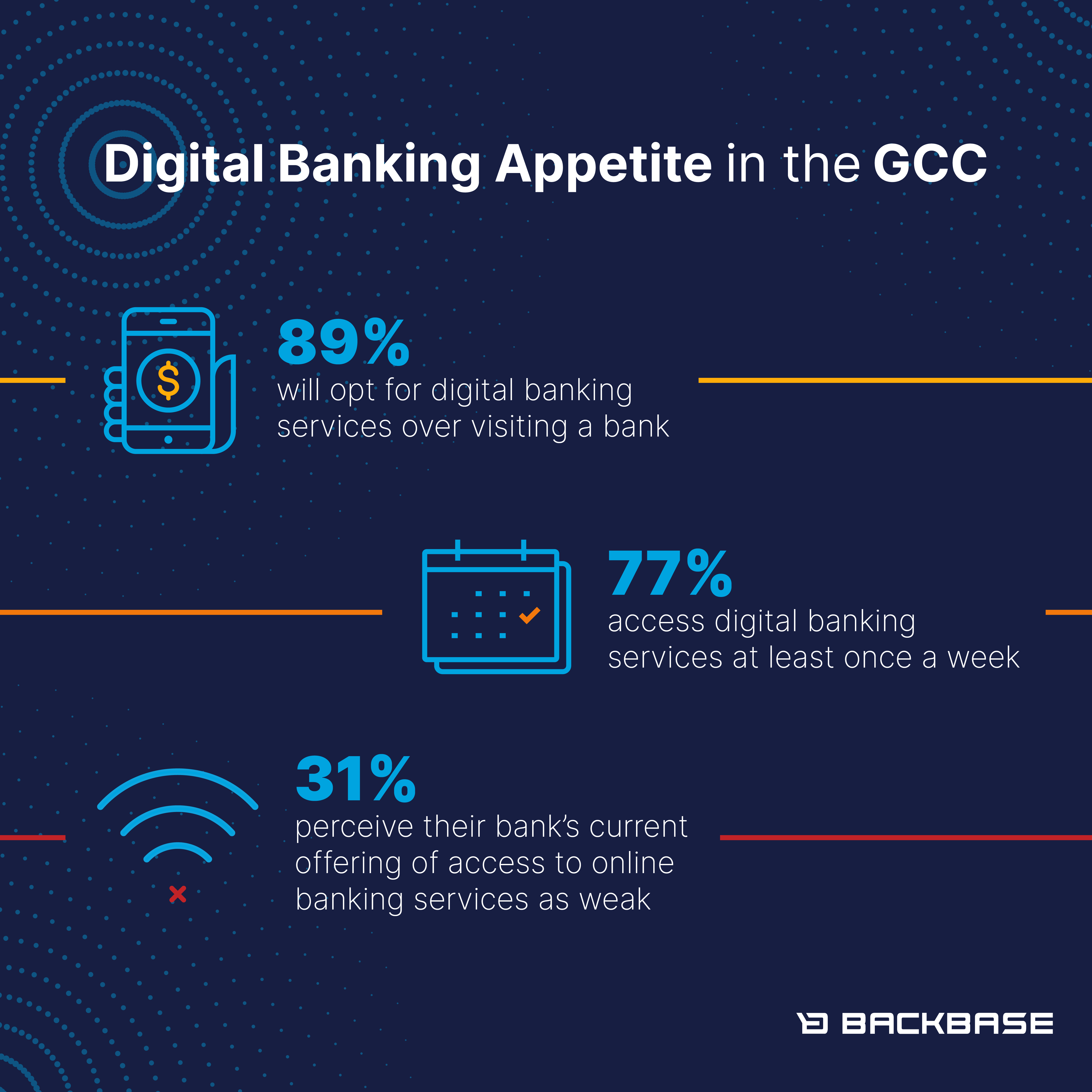

89% of GCC consumers will opt for digital banking services over visiting a physical branch post Covid-19

77% of respondents in the GCC access digital banking services at least once a week 44% are willing to switch to a different bank due […]

Affordable digital banking to revolutionise price-sensitive East African payments market

In a region still dominated by cash and mobile money options, like M-Pesa, new collaborations between fintechs are looking to capture the price-sensitive market with […]