The urban population in Africa has swelled from 15% of the total population in 1960, to over 40% in 2010 and is set to exceed […]

Tag: Digital payments

Tech tipping point

New technology often seems fantastic on paper yet has little impact in the life of the average person. A new tipping solution for fuel pump […]

Peach Payments expands into Mauritius, serves as key event sponsor at Africa FinTech Festival

Peach Payments is pleased to announce that it has set up an office in Mauritius recently in pursuit of its pan-African expansion strategy. As a FinTech […]

Banks across Africa Turn to IBM Hybrid Cloud and AI Solutions to Accelerate Digital Innovation

Africa’s leading banks including EcoBank, Nedbank, Attijariwafa Bank, United Bank of Africa, Co-operative Bank of Kenya and Banco Mais are tapping into IBM technologies to […]

Fintech Startup SOL announces rebrand with exciting new virtual card offering

SOL unveils virtual card and new brand as it redefines the customer experience SOLmate, an online payment platform that offers clients a digital wallet facility, has […]

The Protection of Personal Information Act: How will it impact SA’s payments landscape?

The Protection of Personal Information Act, 2013 (POPIA) came into full effect from 1 July 2021. The Act is the comprehensive data protection legislation that […]

Cash is king – but digital payments are coming for the throne

Even with a high banked population and a multitude of electronic payment options available, the average South African still use cash for daily purchases and […]

Avoiding Instant Electronic Funds Transfer payments Risks

In 2020, e-commerce in South Africa spiked by 66%, driven by COVID-19-induced lockdowns and a drop in brick-and-mortar retail sales[i]. This increase was accompanied by […]

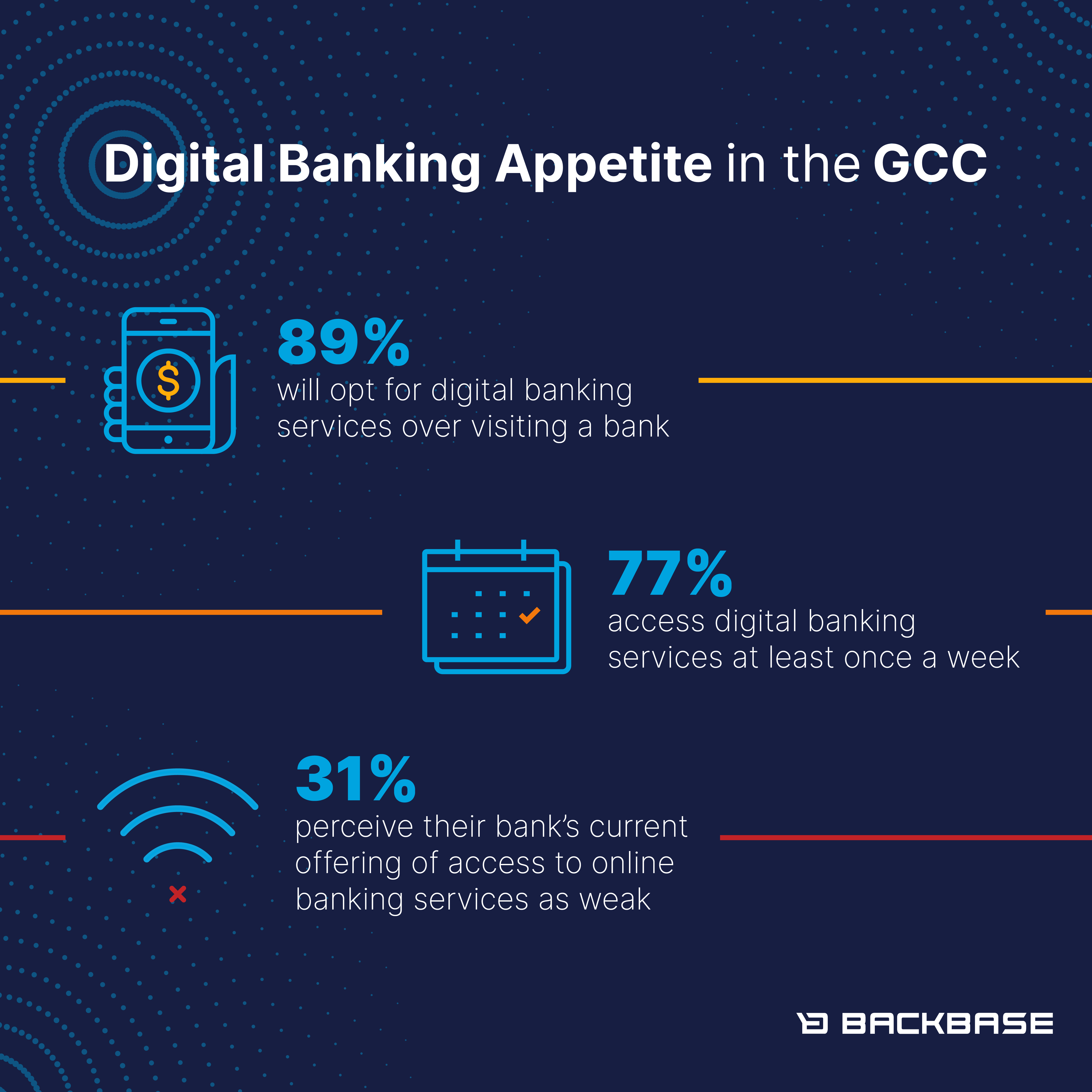

89% of GCC consumers will opt for digital banking services over visiting a physical branch post Covid-19

77% of respondents in the GCC access digital banking services at least once a week 44% are willing to switch to a different bank due […]

South Africa’s Leading Payment Aggregator and Secure Payment Solutions Provider Expands into Africa

With the African Continental Free Trade Agreement set to generate combined consumer and business spending of $6.7 trillion by 2030[i], the continent requires payment platforms […]