With the cost of living increasing often, financial education tools such as budgeting tips can greatly assist with navigating financial health. Experian shares a budgeting plan and tips that South Africans can use to better their saving habits!

Tag: finance

Four steps to fixing cash flow and help SMEs survive

We are all familiar with the saying in business that “cash is king” and, if that’s the case, then cash flow is the lifeblood of […]

African finance heavyweights slated to make an appearance at The Africa Financial Industry Summit

Organised in partnership with the International Finance Corporation (IFC), the inaugural Africa Financial Industry Summit will be held online this coming 10 and 11 March […]

Commitment to sustainability opening doors to post-pandemic capital in Africa

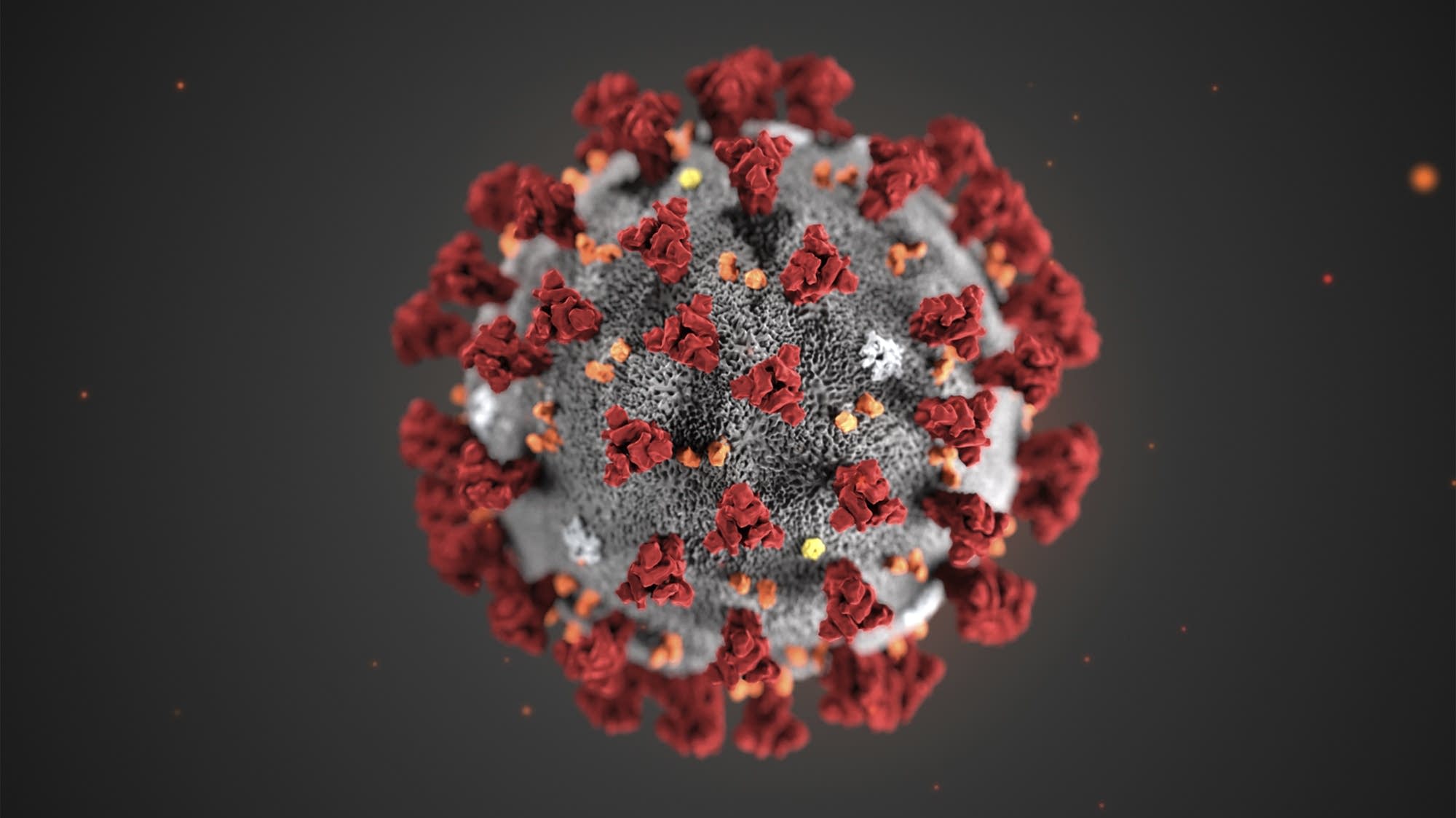

By Wildu du Plessis, Head of Africa, Baker McKenzie The industrials, manufacturing and transport (IMT) sector is being hit hard by COVID-19 disruption, but commitment […]

The impact of COVID-19 on finance and investment in Africa

By Morne van der Merwe, Managing Partner, and Wildu du Plessis, Head of Africa, Baker McKenzie Johannesburg The Coronavirus (COVID-19) has resulted in mass production […]

Trends and Events in Africa 2018

by Johan Burger 2018 has been an interesting year for Africa, with various events and trends becoming visible. 2016 saw the effects of the slowdown […]

Friday@Noon on Financial Services in Africa: 2018

by Johan Burger The NTU-SBF Centre for African Studies publishes a weekly newsletter on issues relevant to Africa. This paper is based on issues addressed […]

How will South African industry deal with tariff hikes and carbon taxes?

African Utility Week to assist Large Power Users to face energy obstacles The proverbial axe is falling on ‘business as usual` as every industry in […]

African Banking innovation sees AfDB approving multi-currency line of credit of USD 300m

By Thandisizwe Mgudlwa The African Development Bank has extended the equivalent of USD 300 million to FirstRand Bank Limited to support projects across Africa This […]

Affordable housing rental market looks increasingly attractive

The South African residential market offers an attractive opportunity in the affordable housing rental segment largely driven by low and middle income earners who […]