“Africa’s new bank for startups and SMEs” to expand to South Africa & Kenya following funding Brass, a Nigerian digital bank delivering easy access to […]

Tag: financial technology

Peach Payments expands into Mauritius, serves as key event sponsor at Africa FinTech Festival

Peach Payments is pleased to announce that it has set up an office in Mauritius recently in pursuit of its pan-African expansion strategy. As a FinTech […]

PLATFORM BANKING AND OPEN BANKING: why it’s the next big thing for banks and their customers

Incumbent banks are starting to look to “platform banking” to stay relevant and loved by customers. But what is platform banking in the first place? […]

Avoiding Instant Electronic Funds Transfer payments Risks

In 2020, e-commerce in South Africa spiked by 66%, driven by COVID-19-induced lockdowns and a drop in brick-and-mortar retail sales[i]. This increase was accompanied by […]

Future proofing banking through the power of data, APIs and automation

The global pandemic has ushered in a new paradigm for the Retail Banking sector, one which demands quicker transformation to a customer-centric service that is […]

M-KOPA Expands to Nigeria, Appoints Babajide Duroshola as New Country General Manager

Connected Asset Financing Platform Commercially Launching After 20,000 Device Pilot 12th July 2021. Lagos, Nigeria. M-KOPA, the leading connected asset financing platform, today announces it […]

Bushra Mahdi appointed as the Brand Ambassador for Tetra Pay International in the GCC and MENA region

Bushra Mahdi is appointed as the brand ambassador for Tetra Pay International INC for the countries in the GCC and the MENA alliance of nations. […]

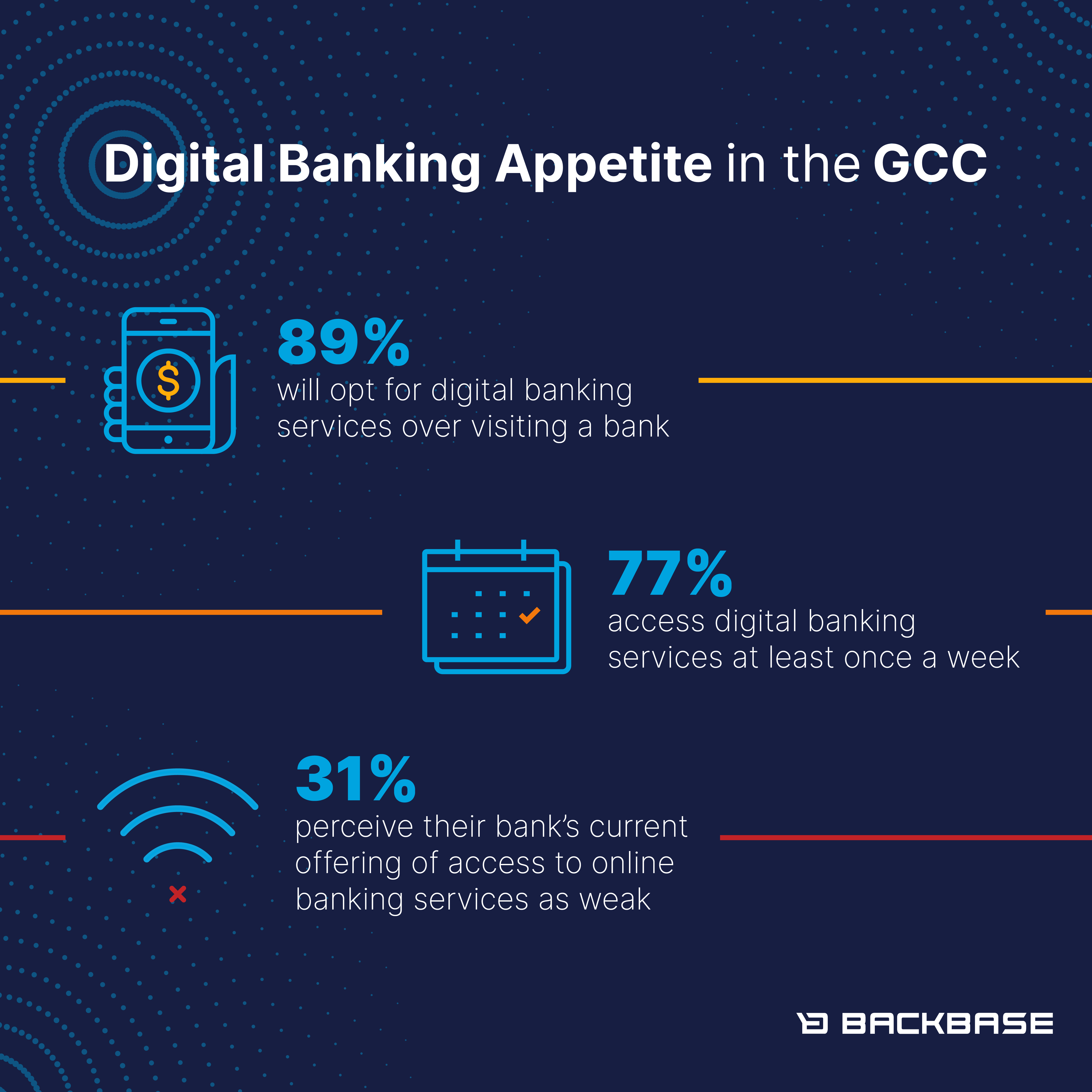

89% of GCC consumers will opt for digital banking services over visiting a physical branch post Covid-19

77% of respondents in the GCC access digital banking services at least once a week 44% are willing to switch to a different bank due […]

Telephonic payment solution helps companies deal with Covid-19 challenges

VerPay enables verbal commerce as businesses adapt to serve their customers in contactless ways As South Africa enters its third wave and lockdown restrictions tighten, […]

Securing the financial institutions’ physical and digital assets with biometrics

Gone are the days when the financial institutions’ (FI) only assets considered to be the gold, cash and other valuables in its vaults. With data […]