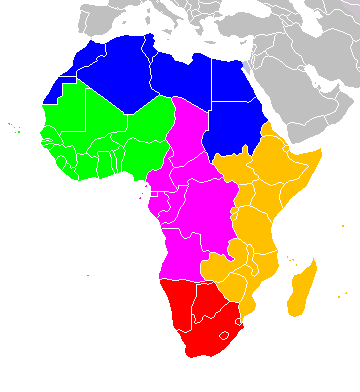

The African Continental Free Trade Area (AfCFTA) is predicted to increase Africa’s trade income by USD 450 billion by 2035 and will boost intra-African trade by more than 81 percent, according to a recent report by the World Bank.

Tag: Free Trade Area

Challenges remain for Industrials, but calculus shifts

Disruption arising from COVID-19 has accelerated trends already apparent in the industrials market –– particularly digitalisation and trade volatility –– and transformation has gone from […]

Africa needs Pragmatic Free Market policies to attract capital into Gas markets

Speaking at the International Petroleum (IP) Week on February 25, 2021, I commended Nigeria for its efforts in driving gas monetization, but we have to […]

Deal making slows across Africa but post-pandemic opportunities look interesting

Deal making activity in sub-Saharan Africa (SSA) dropped in the second half of 2020 (H2 2020), when compared to the second half of 2019 (H2 […]

African dealmaking decreases, the Africa’s Free Trade Agreement expected to boost recovery

Dealmaking activity in sub-Saharan Africa (SSA) dropped in the second half of 2020 (H2 2020), when compared to the second half of 2019 (H2 2019) […]