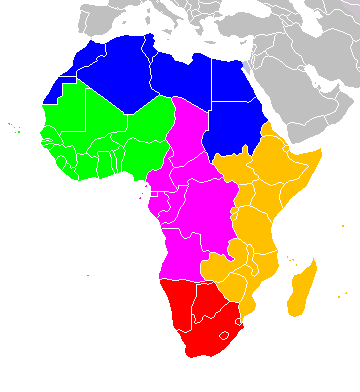

by Pomy Ketema, Counsel, Baker McKenzie, New York The African Continental Free Trade Area (AfCFTA) is one of the largest trading blocs in the world […]

Tag: investing in Africa

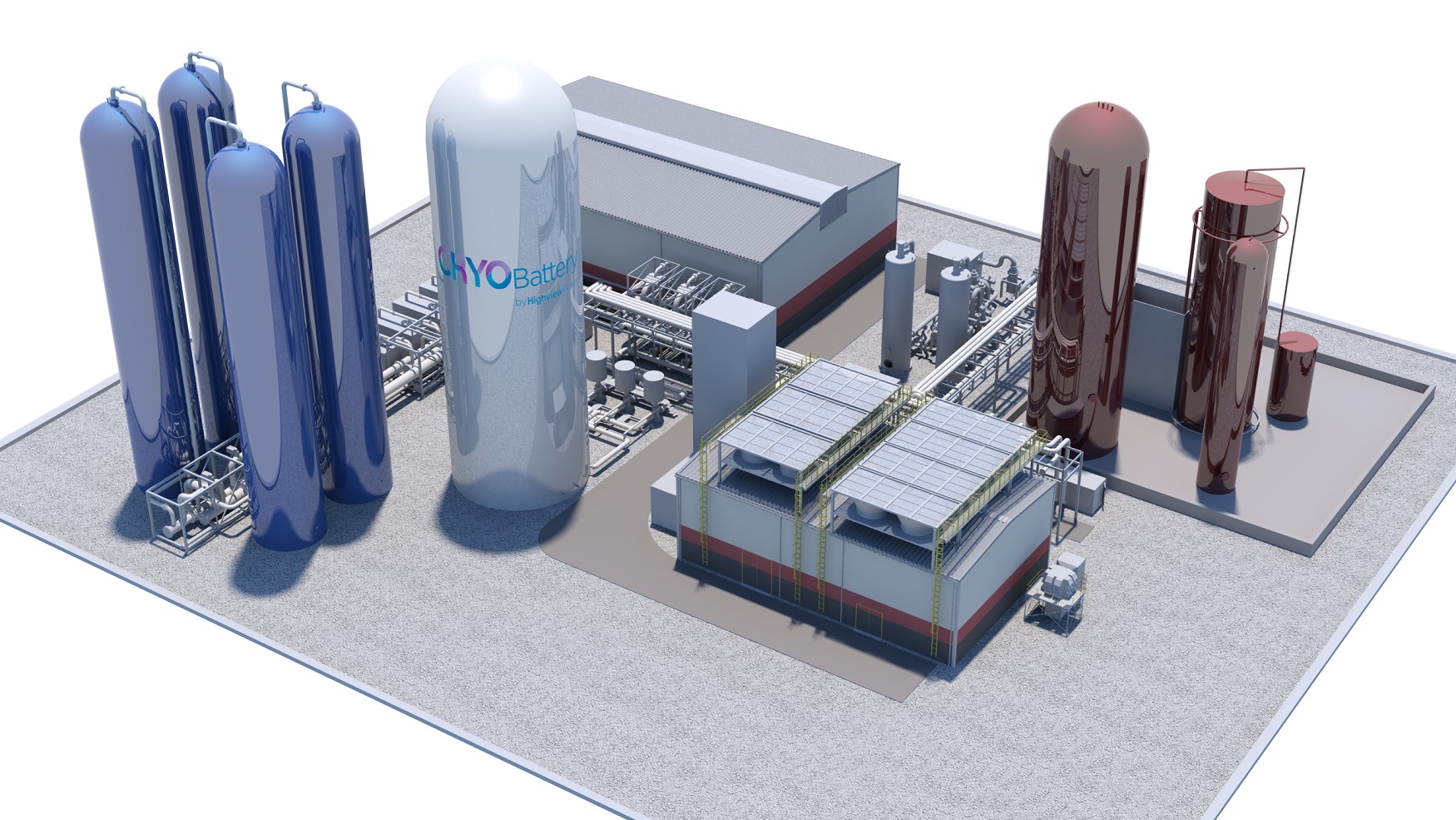

Janus Continental Group (JCG) Invests $13 Million in Highview Power as part of African renewable energy storage drive

JCG’s investment arm Janus Capital takes stake in Highview Enterprise Limited. The deal will bring Highview Power’s cutting edge CRYOBattery™ energy storage technology to JCG’s […]

Commitment to sustainability opening doors to post-pandemic capital in Africa

By Wildu du Plessis, Head of Africa, Baker McKenzie The industrials, manufacturing and transport (IMT) sector is being hit hard by COVID-19 disruption, but commitment […]

Investing in Africa: An Outlook on Nigeria and Ethiopia

Itumeleng Mukhovha, an associate in the Corporate/M&A practice at Baker McKenzie in Johannesburg One can easily assume that international investors are deterred from investing in […]

African trade amongst African countries: with the groundwork laid, innovation and infrastructure investment are needed to unleash the continent’s economic potential

By James Hall Analysis in Brief: The benefits of boosting the low rate of trade amongst African countries are undeniable. The countries signing on to the […]

Richard Chandler Corporation Invests in Union Bank of Nigeria

SINGAPORE, 2012 /PRNewswire/ — The Richard Chandler Corporation announced that it has invested US$112 million to support the recapitalisation of Union Bank of Nigeria […]