By Morne van der Merwe, Managing Partner, and Wildu du Plessis, Head of Africa, Baker McKenzie Johannesburg

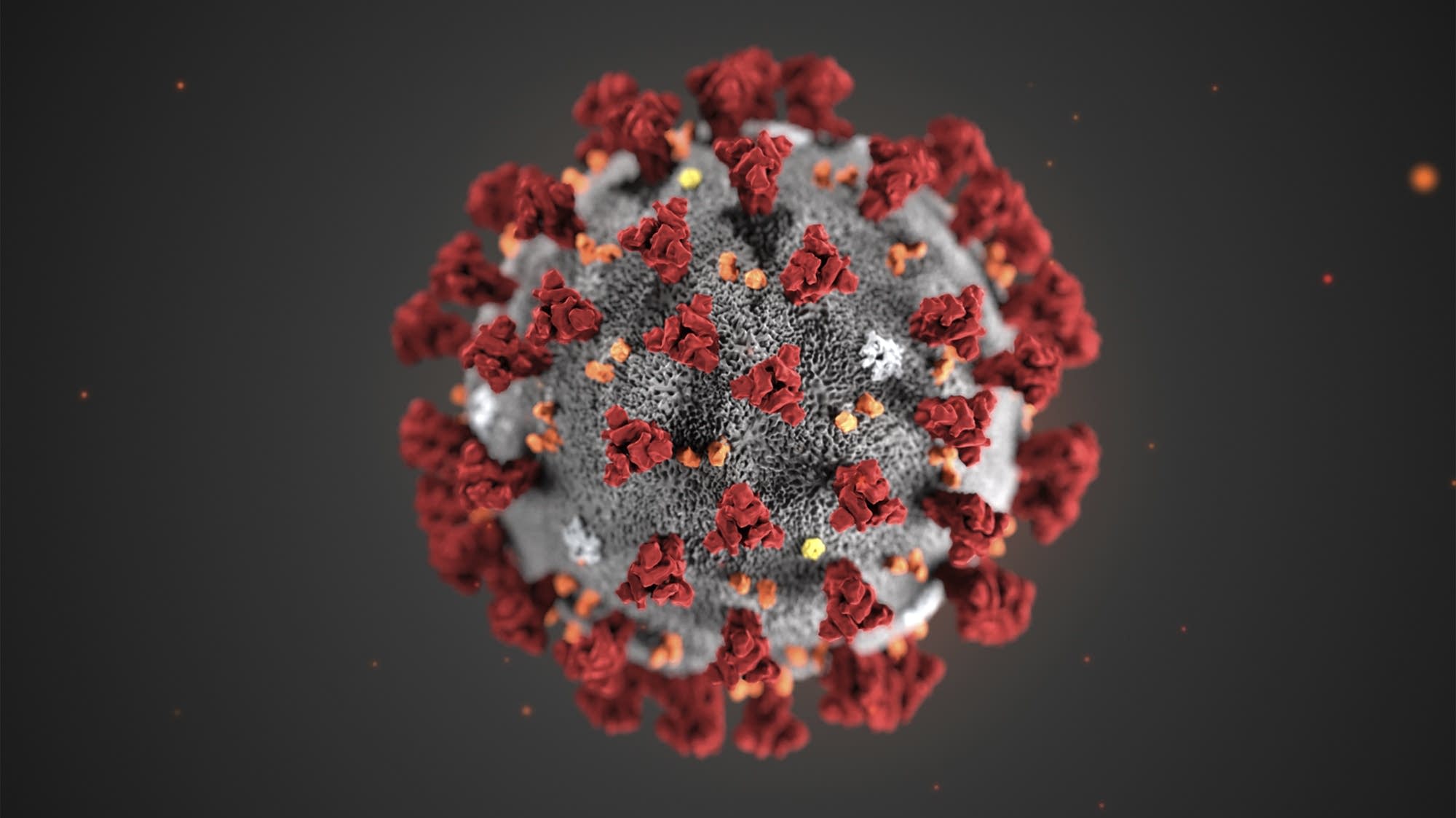

The Coronavirus (COVID-19) has resulted in mass production shutdowns and supply chain disruptions due to port closures in China, causing global ripple effects across all economic sectors in a rare “twin supply-demand shock”. With South Africa having just reported its first cases of COVID-19, Africa is beginning to feel its full impact and plans to control and manage the humanitarian challenges of the virus are underway across the continent. Economically, the effects have already been felt – demand for Africa’s raw materials and commodities in China has declined and Africa’s access to industrial components and manufactured goods from the region has been hampered. This is causing further uncertainty in a continent already grappling with widespread geopolitical and economic instability.

The number of cases is reportedly slowing down in China, increasing expectations that it will eventually reach a plateau and be brought under control. However, in early March the Organisation for Economic Co-operation and Development noted that “annual global GDP growth is projected to drop to 2.4% in 2020 as a whole, from an already weak 2.9% in 2019, with growth possibly even being negative in the first quarter of 2020”, with global markets plunging in the days thereafter.

Although Chinese growth will fall in the short term, it is expected to rebound quickly, some suggesting this could even happen in the second quarter of 2020 when the virus will hopefully be contained. In the meantime, central banks are implementing measures to mitigate the effects of the virus on the economy, cutting interest rates and injecting liquidity into the banking systems in some countries.

In early March, the World Bank announced it would commit USD 12 billion in aid to developing countries to help them to deal with the impact of the virus and limit its spread. The Bank said it would prioritise the most at-risk countries. The World Bank also introduced a pandemic bond in 2017, which, as part of the Pandemic Emergency Finance Facility intended to provide money to help developing countries in the event of a pandemic reaching certain thresholds and conditions. So far, these criteria have not been met and the bond has not paid out.

Uncertainty regarding the spread of COVID-19 is high and its impact on Africa is expected to be serious, given the continent’s exposure to China. So far, cases have been reported in Algeria, Cameroon, Egypt, Morocco, Nigeria, Senegal, South Africa, Togo and Tunisia. If there is a widespread outbreak of COVID-19 in Africa it could overwhelm already weak healthcare systems in the region.

According to ratings agency, Fitch, the Coronavirus outbreak will have a downside risk for short term growth for sub-Saharan African growth, particularly in Ghana, Angola, Congo, Equatorial Guinea, Zambia, South Africa, Gabon and Nigeria – all countries that export large amounts of commodities to China.

Impact on Merger & Acquisition activity

Africa has come through a period of prolonged political and economic uncertainty, but signs of future economic improvement, were pointing to a modest increase in M&A activity in Africa over the next few years. COVID-19 is likely to hamper this predicted upturn and result in increased short-term uncertainty in terms of how it will affect investment opportunities in Africa, the continent’s productivity and consumer demand.

There are other transactional risks. If the virus spreads rapidly in Africa, countries might have to introduce similar measures to those taken in China where areas were locked down, factories were shut, quarantines enforced and travel bans imposed. As such, these events could potentially be significant enough to trigger a change to the terms of an M&A transaction currently in progress, and deals could be delayed as a result. COVID-19 conditions could also cause delays to M&A due diligence, necessary for a transaction to progress to finalisation. Further, the virus could qualify as a force majeure event causing more delays or terminations.

We are hopeful the rebound from COVID-19 will coincide with the implementation of the African Continental Free Trade Area (AfCFTA) in July 2020, which should provide an additional boost to deal activity in Africa the coming years. The AfCFTA is the first continent-wide African trade agreement, with the potential to facilitate and harmonise trade and infrastructure development in Africa. This boost to the investment environment will be welcome after the additional uncertainty of dealing with COVID-19 impacts.

Impact on Capital raising and IPOs

African issuers have been waiting several years for an improvement to political and economic instability in Africa before going ahead with any planned capital raising. As a case in point, Baker McKenzie’s Global Transactions Forecast showed that there were no IPOs in South Africa in 2019. Also eroding investor confidence were the numerous global trade tensions, with capital raisers watching for signs of resolution before launching IPOs. With Africa looking to benefit from new global and regional trade agreements, the forecasts had been pointing to a potential recovery in capital markets in the next few years, but this might be delayed as the uncertainty around the impact of COVID-19 in Africa reaches its peak. IPOs in the region are therefore expected to decline, not directly because of the virus as is the case with equities, but because COVID-19 will have an effect on the underlying business case for IPO companies, which will impact on their ability to raise capital

Impact on financial institutions

Global financial institutions are currently assessing the impact of COVID-19 and reacting to its economic impact, ensuring they are able to adjust to new and unprecedented circumstances brought about by the virus. It remains to be seen whether the huge global economic downturn caused by decreased output in China will impact on African lenders and compel financial institutions on the continent to be more lenient towards borrowers and cut them some slack.

Impact on Local Markets

Since global economic growth is a key driver of commodity prices, local prices have been driven down by the virus’s global impact. The uncertainty of the impact of COVID-19 on local markets is expected to lead to increased risk aversion from investors who are waiting to see its potential impact in Africa. On the plus side, a temporary fall in share prices provides opportunities for prudent investors.

Impact of the Insurance sector

Both businesses and individuals in Africa might find they are uninsured for any COVID-19 impacts as losses related to an epidemic or pandemic would usually not be covered in insurance policies, irrespective of whether the insurance covers business interruption, property damage, product losses or personal life and non-life insurance or even travel insurance. As COVID-19 is a new disease, it would not have been specifically listed in existing insurance contracts. Many business interruption policies will include clauses for extended damage, but it is unlikely that these extensions will provide coverage under the current circumstances. As such, the wording of policies should be carefully checked.

Some insurance companies who provide cancelled event coverage that specifically includes references to epidemics or pandemics could be impacted. Reuters reported that financial services firm Jefferies estimated the insured cost of the Tokyo Olympics to be around USD 2 billion – including television rights, hospitality and sponsorship.