By Kylie Slambert, Associate and Ethan Chetty, Candidate Attorney, Dispute Resolution, overseen by Darryl Bernstein, Partner and Head of the Dispute Resolution Practice, Baker McKenzie Johannesburg

The International Centre for the Settlement for Investment Disputes (ICSID) has, since 1966, been recognized widely as the leading institution for alternative dispute resolution in disputes between states and individual investors. The theoretical utility of such conventions is relatively straightforward: in the same manner that international commercial arbitration, in combination with the New York Convention on the Recognition and Enforcement of Foreign Arbitral Awards, fueled the rapid expansion of global commerce by offering parties to international commercial contracts a mechanism to expeditiously resolve disputes, the ICSID Convention was designed to encourage foreign investment into states with the promise that, should anything go wrong, there would be recourse in the form of enforceable awards.

ICSID Caseload – Statistics

The latest issue of the ICSID Caseload – Statistics reveals that 2021 was a record setting year for cases registered by ICSID under the ICSID Convention, with promising signs of growth in 2022 so far. The vast majority of claims pertain to international oil, gas, mining and energy investments. This was, no doubt, a result of the after-effects of the COVID-19 pandemic, which exacerbated underlying investment disputes, as well as interruptions to the global supply chain caused by geopolitical conflict.

ICSID African cases

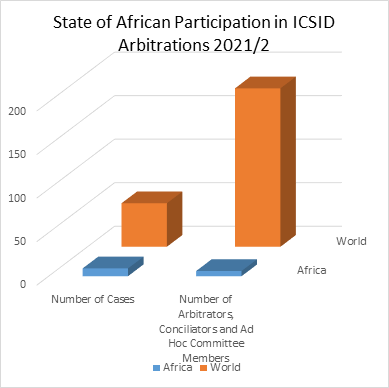

Despite the global trend towards ICSID arbitration, African countries form the minority of cited states in recent proceedings. According to the ICSID Caseload – Statistics, the geographic distribution of new cases registered in FY2022 under the ICSID Convention, shows that, for sub-Saharan Africa (SSA), two cases were registered in the Republic of Congo, two in Mali, one in Senegal and one in the Republic of Sudan. Further, only two percent of arbitrators, conciliators and ad hoc committee members appointed in FY2022, in cases registered under the ICSID Convention and additional facility rules, were from SSA.

South Africa

South Africa is a jurisdiction opposed to ICSID proceedings, since the matter of Piero Foresti, Laura de Carli v Republic of South Africa ICSID, which challenged transformative constitutional and statutory provisions in South African law, and resulted in the termination of its European Bilateral Investment Treaties and the promulgation of the Protection of Investment Act 22 of 2015.

Section 13 of this Act requires that the South African government may only consent to international arbitral proceedings once all domestic remedies have been exhausted. Accordingly, international investment disputes with the Republic of South Africa need to be mediated and litigated in South Africa by way of a court, independent tribunal or statutory body, as a first port of call.

Other African jurisdictions

Other African jurisdictions are not similarly opposed to these proceedings. Mauritius has become a gateway jurisdiction for investment into Africa. Tanzania, Nigeria, Ghana, Zambia and Kenya have provided a variety of growth opportunities for infrastructure investments, structured trade and commodity financing, among other investment opportunities.

Challenges

Parties seeking to initiate proceedings and enforce awards in African countries, however, often face a multitude of mainly practical challenges. These include that:

- ICSID proceedings generally require the application of novel, intricate and complex laws from multiple jurisdictions.

- ICSID proceedings generally require multijurisdictional co-ordination efforts to investigate, collect evidence and sustain proceedings.

- Enforcement proceedings generally require a great deal of legal, as well as political and social sensitivity to the award debtor state.

Disputes are becoming increasingly frequent and complex for businesses with operations across Africa. As businesses continue to enter new markets against a backdrop of tighter regulatory scrutiny, increased digitization and higher accountability, legal advice that offers an interconnected, multijurisdictional, cross-border approach to arbitration and dispute resolution, has become essential.