Despite 25% plunge in spending in 2022 amid economic downturn, AppsFlyer’s 2023 State of eCommerce report showcases some positive retail global trends in a shifting economic landscape

AppsFlyer today released the 2023 edition of its State of eCommerce App Marketing report, an in-depth look at key global industry trends to guide retail marketers in building a mobile-first experience that drives engagement and sales for the second half of 2023, especially during the peak holiday season.

While retail marketers continue operating in an uncertain economic landscape, last year’s Q4 holiday shopping season, which saw more in-app purchases by consumers compared to Q4 in 2021, should provide a glimmer of hope. Consumer spending on shopping apps climbed 37% in Q4 2022 compared to Q3 2022, 30% higher than the rise in 2021 over the same period. On average, retail apps generated 10% more revenue in the peak shopping month of November 2022 compared to November 2021. Additionally, In-app purchases (IAP) remained high throughout the entire holiday season, suggesting that retailers focused on attracting customers with early discounts and continuous holiday season incentives, leading to shoppers making return visits to their favorite shopping apps and also making repeated purchases, which drove shopping’s economic engine.

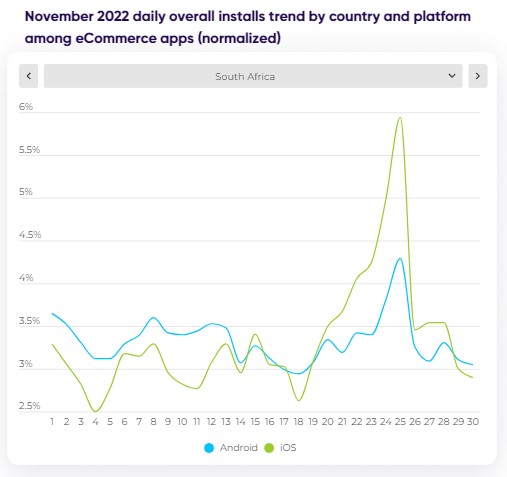

“Black Friday in South Africa last year once again showed its prowess in terms of app installs, with iOS installs rising by more than 30%, and Android installs increasing by more than 15% on this day, compared to the daily average in the month of November, showcasing the importance of this period in particular for eCommerce apps,” said Netta Lev Sadeh, Managing Director EMEA SANI, AppsFlyer. “It is critical for app marketers to start their planning now leading up to this year’s Black Friday if they want to maximize this vibrant shopping period. Disruptive user acquisition campaigns could be paramount in the months leading up to Black Friday, and if executed successfully, could be the defining point in the increase or decrease in app installs.”

Key Africa insights from the 2023 State of eCommerce:

-

Nigeria recorded a 22.3% rise in total eCommerce app installs from Q1 2022 to Q1 2023 on iOS.

-

In South Africa, eCommerce app installs on iOS devices surged significantly by 81.5% from Q1 2022 to Q1 2023, dwarfing the 15% rise seen on Android devices within the same period of time.

-

Surprisingly, in Algeria, there was huge growth in total eCommerce app installs from Q1 2022 to Q1 2023 on Android devices, recording a whopping 54% increase.

-

In South Africa, non-organic installs rose by more than 60% during the summer of 2022.

-

South Africa’s remarketing share peaked at 76% in April 2022, but by February 2023, had dropped down to 65%.

-

South Africa’s share of paying users peaked in November 2022, a testament to the month of Black Friday. November truly carries more gold in its pocket than any other month for eCommerce apps. The period from the 25th to the 27th of November emerges as the prime time for app installs in the region, driven by the frenzy of Black Friday. This period registers a marked increase across all platforms, with iOS numbers outpacing Android. On November 25th alone, Android installs rose by 30 % over any other day in the month in South Africa, while iOS saw a steeper climb of 78%.

Key Global Insights from the 2023 State of eCommerce:

-

In-app consumer spend increased 81% on Black Friday 2022 compared to the daily average in the month of November, with Android averaging 61% higher

-

eCommerce marketers spent $4.9 Billion on attracting app users worldwide in 2022, with the economic downturn leading to a 25% drop in spend in H2 2022.

-

Apple iOS apps had an 85% higher share of paying users compared to Android, and November conversion rates were 15% higher compared to the monthly average on both iOS and Android platforms.

-

Cost of Media in the eCommerce vertical has significantly dropped 30% YoY when comparing Q1 of 2023 to Q1 of 2022.

-

Marketers’ customer acquisition costs, measured in Cost Per app Installs (CPIs), peaked in November 2022 and dropped 30% when comparing Q1 of 2023 to Q1 2022 – more specifically, decreasing 33% on iOS and 11% on Android.

-

Marketing-driven non-organic installs (NOIs) rose 19% on iOS thanks to a drop in CPIs and increased confidence in measurement in the post-iOS 14.5 app environment.

-

Marketers are focusing on remarketing as it remains a vital and cost-effective component of the global marketing landscape, consistently boasting a share of over 40% monthly.

“The impact of the downturn on ad spend as seen during the first quarter of 2023 has been significant with marketers cutting budgets, but the success of the 2022 holiday season, even amidst the prevailing financial slowdown worldwide, should instill greater confidence in marketers as they plan for the upcoming holiday season,” said Shani Rosenfelder, Director of Content Strategy & Market Insights, AppsFlyer. “Emotional marketing offers a greater resonance now more than ever, so marketers should stay attuned to the needs and sentiments of their audience to connect with them on a deeper level.”

Methodology

AppsFlyer’s State of eCommerce App Marketing, 2023 Edition is an anonymous aggregate of proprietary global data from 3.7 billion app installs from 8,500 eCommerce apps and 22 billion remarketing conversions.

Learn more:

-

The full report for the State of eCommerce App Marketing is available here.

-

See how AppsFlyer can help you deliver high-converting customer experiences across every channel, platform and channel here.