- Businesses are finding ways to adapt to loadshedding

- South Africa narrowly missed a technical recession with surprise GDP growth

- Interest rate hikes led to increase of credit extension through unsecured lending

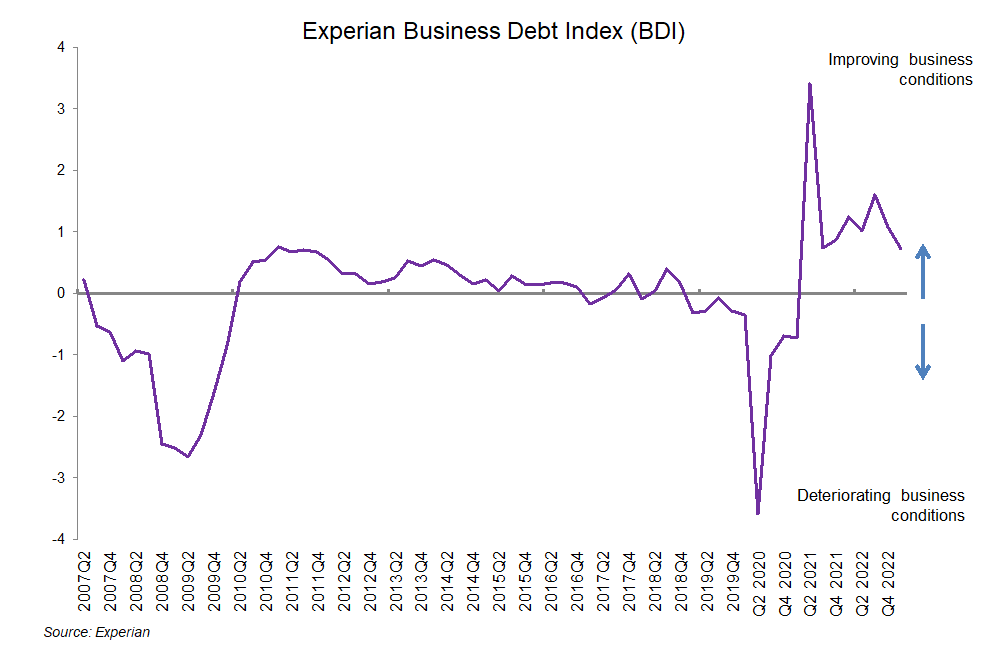

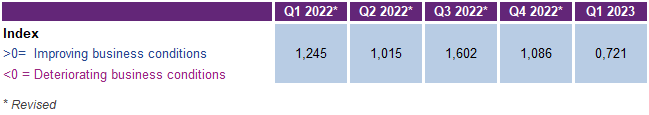

The Experian Business Debt Index (BDI), which reflects the relative ability for business to pay their outstanding suppliers/creditors, indicating the overall health of businesses in the economy, declined at a better-than-expected rate for Q1 of 2023. The decline to 0.721 from an upwardly revised 1.086 reading for Q4 2022, is attributed to a better-than-expected economic performance for the period.

“Three months ago, one had been contemplating an economic scenario of substantial decline due to a significant intensification of load-shedding through Q1. However, the impact was not quite as severe as had been perceived,” says Jaco van Jaarsveldt, Head of Commercial Strategy and Innovation at Experian Africa.

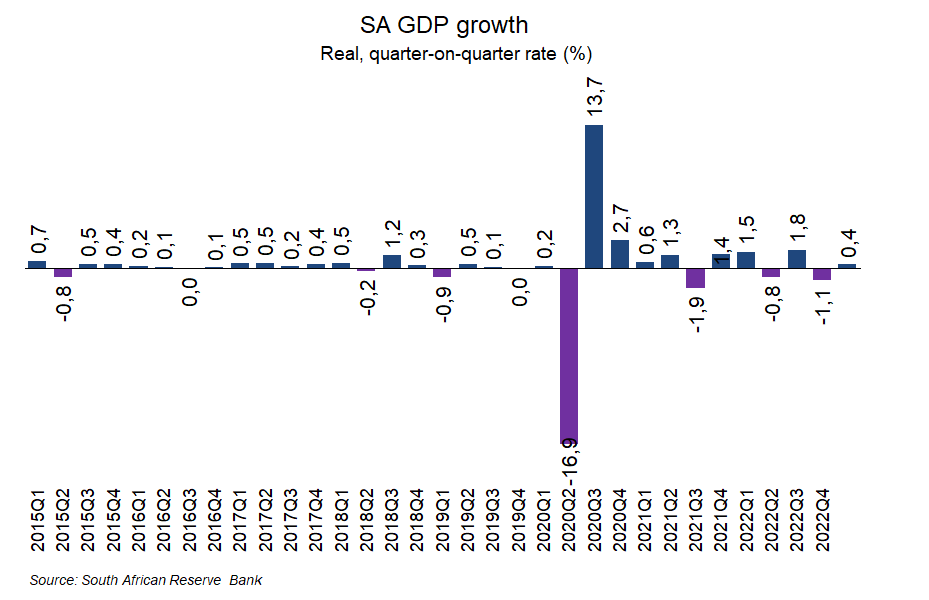

GDP growth came in at a positive 0.4% quarter-on-quarter. This represented an increase from the -1.1% economic contraction experienced in Q4 of 2022 and ensured that the economy had not registered a technical recession, represented by two consecutive quarters of negative growth.

Nonetheless, the negative impact of load-shedding continued to be felt, especially by the agricultural sector, which contracted by 12.3% quarter-on-quarter in Q1. However, it is also apparent from the resilience of mining and manufacturing output in Q1, and positive growth in financial services, transport and retail and wholesale trade, that businesses and consumers are coping with the scourge of load-shedding much better than anticipated.

“Purchases of generators and solar panels are clearly helping to diminish the impact caused by a lack of electricity, whilst a fairly reliable programme of load-shedding issued by Eskom enables many to adjust activities to minimise the negative effect. Economic headwinds were not confined to increased load-shedding alone. Sustained relatively high inflation and an accompanying increase in interest rates to their highest levels in a decade, also worked against stronger economic growth,” adds van Jaarsveldt.

Continued financial distress for SMEs

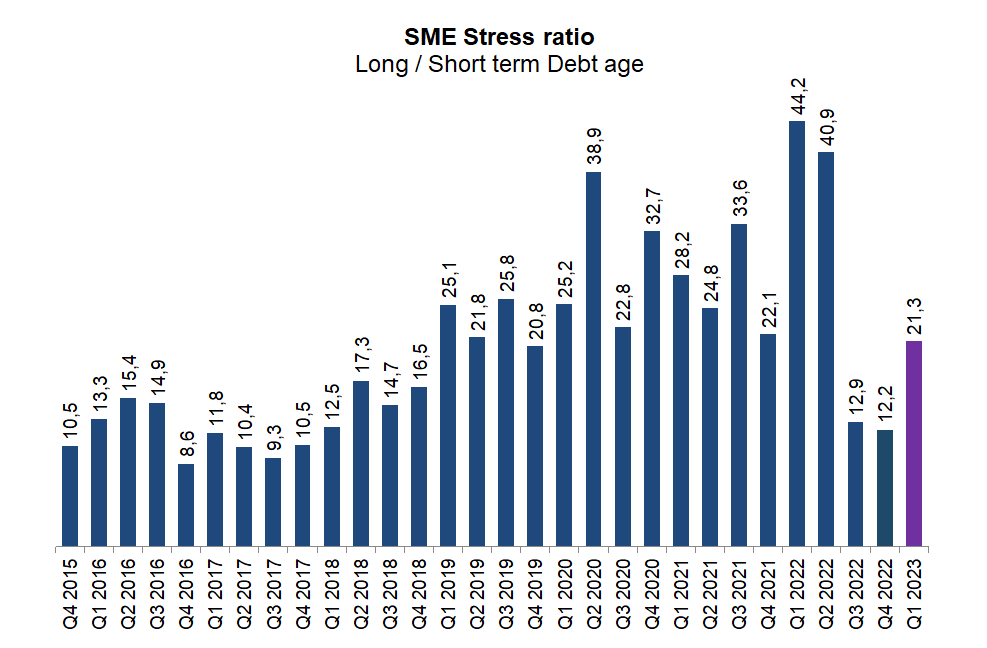

The SME debt stress ratio, calculated in the BDI, rose sharply to 21.3% in Q1 2023 from 12.2% in Q4 2022. These figures suggest that there has been a much more marked deterioration in the financial health of small businesses than large-size enterprises.

This is not altogether surprising given the difficulty that small businesses have in coping with the expenses required to undertake adjustments in energy procurement to lessen the impact of load-shedding.

Surprising improvement in electricity sector

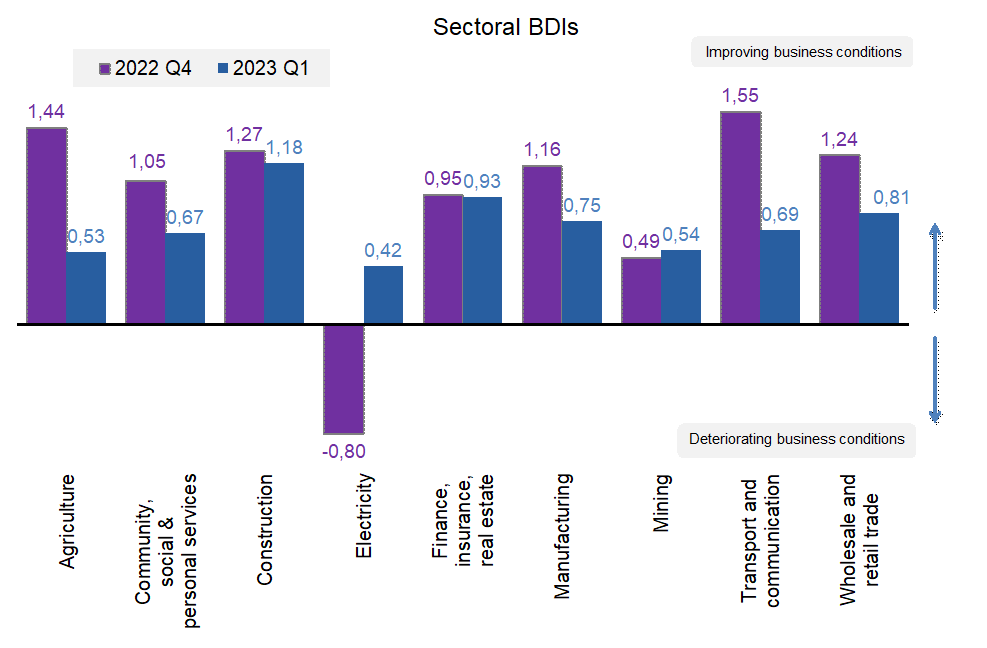

From a sectoral perspective, the nine main sectors of the South African economy recorded a positive BDI in Q1. However, the trends between the Q4 2022 readings and those of Q1 2023 differed materially between sectors.

On the positive side, there was an improvement in the BDI for the electricity sector, which had been negative in Q4 of 2022 but turned markedly positive in Q1 on the back of increased, yet interrupted, seasonal demand.

In contrast, the decline in agricultural output in Q1, due to the impact of load-shedding, was reflected in a deterioration in the BDI for the agricultural sector. The BDI for transport and communication also recorded a substantial decline, reflecting the impact of the worsening of the country’s rail network.

“By now, one might have expected the BDI to be in negative territory. Resilience in the face of anti-growth forces and structural impediments has been surprising. Encouragingly, it is widely predicted that one can begin looking forward to an increase in electricity availability towards the end of this year and through 2024. This period is also potentially pivotal in determining whether the declining trend of the South African economy over the long term persists and accelerates or whether changes in the political sphere begin generating an underlying improvement in the country’s economic growth,” van Jaarsveldt concludes.