South Africa is moving very fast in the direction of the FinTech industry. The country is very determined not to be behind the whole show. […]

Category: Fintech

Fintech Africa

N’Gunu Tiny on How blockchain funding will disrupt the games industry in Africa

N’Gunu Tiny, Founder and Executive Chairman of the Emerald Group is an expert in Fintech, blockchain and innovative tech. Here’s his take on the impact […]

How Fintech can help secure the world from the economic impact of viral pandemics

The coronavirus pandemic continues to turn the world and our lives upside down, with the outbreak forcing governments to put into place measures that reduce the […]

How fintechs are making Africa a leading global Innovation Hub

In a continent where over 60% of the adult population is unbanked and the financial sector is considerably underdeveloped, fintech has been a welcomed revolution […]

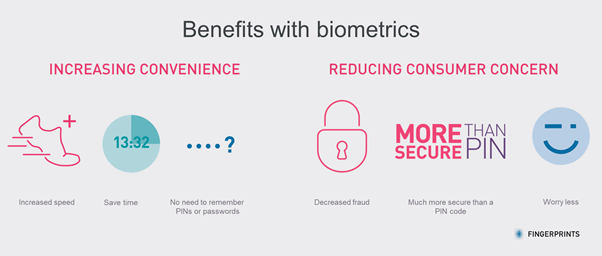

The Human Touch: Biometrics Yesterday, Today and Tomorrow

By Christian Fredrikson, CEO, Fingerprints For thousands of years, humanity has used fingers to express itself. Crossing one’s index and middle fingers in the West […]

Biometric payments – forget sensor size, focus on performance

By Jonas Nilsson, Product Manager at Fingerprints Biometric authentication has come a long way in recent years. Launched in the first Android smartphone almost five […]

Consolidation of the fintech ecosystem in Africa, Good or Bad?

‘Mobile money’ used to be a catch-all phrase, describing everything from consumer wallets to building agent networks, lending, and international remittances. However, African fintech has […]