Happy Pay raises $1.8 million pre-seed round and secures inaugural debt facility as it accelerates its mission of bringing the cost of consumer credit to zero for South Africans.

Category: Fintech

Fintech Africa

Fintechs need to overcome regulatory barriers that limit access to financial services for underserved communities

Nikki Kettles, Licences and Payments Regulation Executive at Mukuru, discusses how regulatory barriers often limit fintech innovation and hinder access to financial services for these communities. She highlights the importance of collaboration between fintechs and regulators in overcoming barriers to innovation and expanding access to financial services for underserved communities. Mukuru’s success in holding 49 licenses across 15 countries underscores its deep commitment to working closely with regulators while expanding financial access.

Remain vigilant in the face of increased banking scams urges the SAFPS

The end of the year is fast approaching, and with it, the festive season and general anticipation for that hard-earned vacation that many South Africans work so hard for during the year. While this is a time of good cheer and increased shopping activity to prepare for the December break, it is also a busy time for scammers who want to take advantage of this activity. Many South Africans have recently contacted a popular Johannesburg radio station reporting increased attempts at banking fraud, with scammers sometimes becoming increasingly aggressive and convincing.

Tapping into India and Africa’s strengths to drive a financial revolution

Vinesh Kassen, Head of India Client Coverage at Absa CIB, explores how successful digitisation projects have revolutionised the way that India and Africa interact with financial services, and why leveraging both regions’ capabilities will help deepen ties.

From vision to reality: How Absa CIB’s new TVC champions human centred relationships

In the fast-evolving landscape of financial services, distinguishing oneself requires more than just competitive solutions and services. To achieve success, it requires a deep understanding of your clients’ needs, an empathetic approach, and a commitment to their success. This approach underscores Absa Corporate and Investment Banking’s (CIB) latest campaign, which showcases not only that “Your story matters” but that Absa CIB is truly “Invested in your story.”

Shift to omnichannel payments in retail to drive efficiencies and enhance CX

Quintin van der Linde & Don Lange from Ecentric Payment Systems explains why a shift to omnichannel payments in retail is key to drive efficiencies and enhance CX for the future.

Fintech’s transformative potential: Empower customers through self-education

The most powerful thing a fintech can do is enable its customers to educate themselves. Mukuru, a leading next-generation financial services provider, started out as a remittance company but has evolved into a platform with a suite of different financial products and services. Mukuru CEO, Andy Jury, says that formalised financial education obviously plays a crucial role in a fintech’s business, but customers that trust and repeatedly use a new product or service, such as a digital store of money, go through a natural learning process and are then more comfortable being exposed to more sophisticated products.

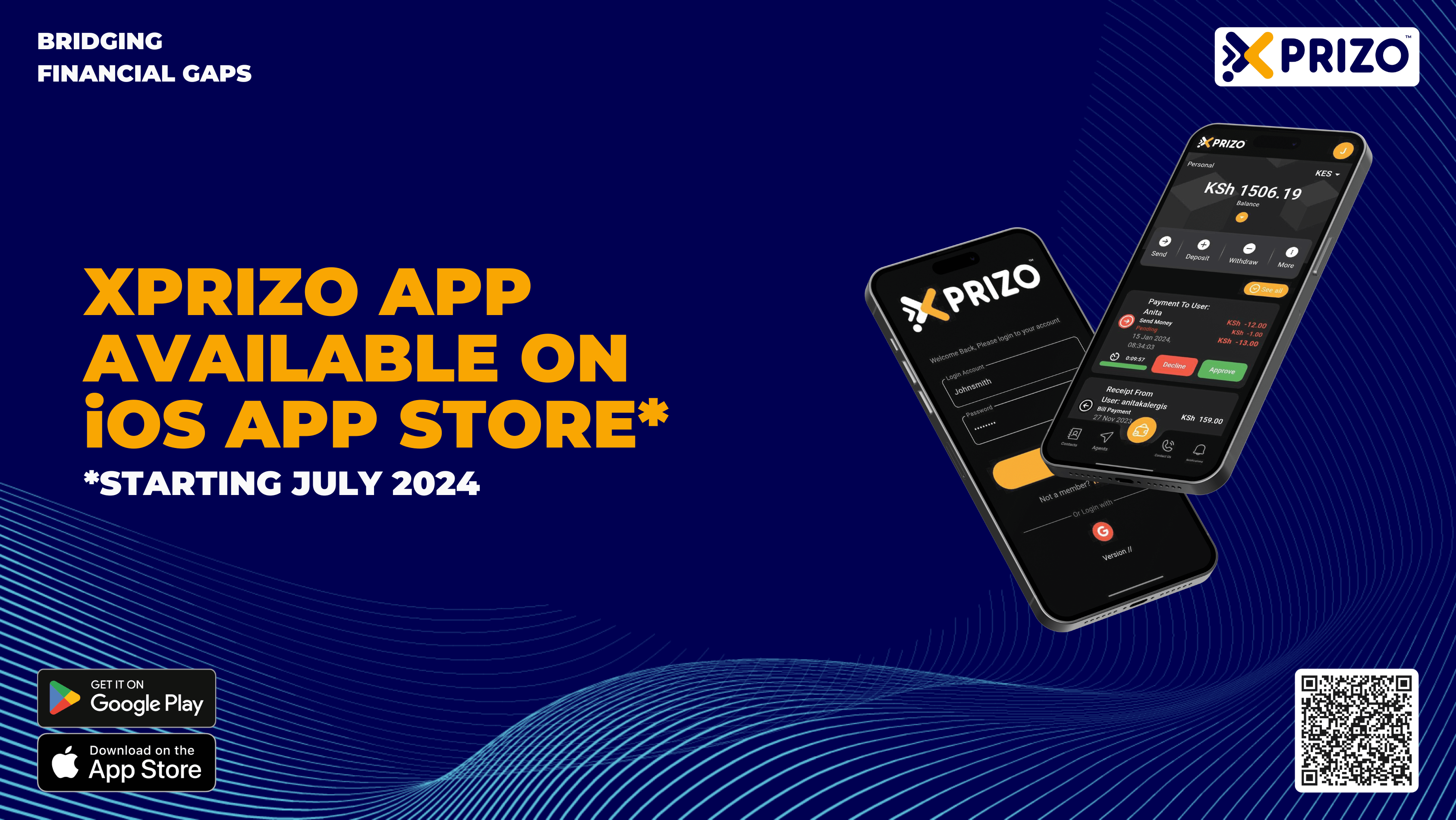

Xprizo enhances fintech platform with iOS launch

Xprizo, a cutting-edge iGaming fintech platform, has amplified its global reach with the launch of its iOS app. This marks a significant milestone in the company’s growth and development as a fintech platform serving the underbanked and unbanked demographics.

Under Attack: Online Sellers Face Mounting Threat from Payment Scams

When it comes to online shopping, it’s not just customers who can fall victim to scams. Many scams target businesses and sellers, making it essential for anyone selling goods online to understand how to avoid these pitfalls and what steps to take if their business is affected.

Investment bank predicts Africa’s remittance market will reach $500bn by 2025

Remittances are a vital cog in the African economy, but they remain relatively costly compared to the rest of the world. Despite this, investment bank DAI Magister sees African remittances primed as a market primed for investment, and predicts it will grow to $500bn by 2025. For Risana Zitha, Managing Director and Head of Africa at DAI Magister, the shift to mobile money will bring a wave of innovation, lowering remittance costs and propelling the market to new heights.