The Africa Fintech Summit is proud to announce Flutterwave as the Lead Fintech Sponsor for its highly anticipated 10th-edition summit, set to take place in Lusaka, Zambia, on November 2-3, 2023.

Category Archives: Fintech

Fintech Africa

To address the rampant inequality in many African economies today, companies are demonstrating a customer-centric approach that drives formal financial and economic inclusion. In this article, Mukuru CEO, Andy Jury, shares a multi-faceted approach to addressing barriers to formalisation and how to create a more inclusive and equitable landscape in South Africa – offering accessible, low cost remittance services and digital solutions while maintaining a physical presence.

Three pilots, one fully launched digital currency in Africa The world’s central banks understand that the future of money is digital. As payments shift online, the use of cash declines and the fortunes of crypto assets rise and fall, central bankers realise that their ability to command the use of money in their economies could […]

Scan to Pay, powered by Ukheshe, is the largest QR ecosystem in South Africa and is used by more than 600,000 vendors, 14 banks and fintech companies and 94 payment service providers. Now, this new partnership will seamlessly introduce more crypto payment options to mainstream South Africa through the Scan to Pay app.

The recent GSMA 2023 State of the Industry Report on Mobile Money highlights how mobile money has become a mainstream financial tool in many African countries.

While financial inclusion is growing in importance worldwide there is still a discrepancy between male and female financial inclusion – the so-called gender financial inclusion gap.

The Africa Money and DeFi Summit has announced nine ventures selected to showcase their cutting-edge Web3, Blockchain, Fintech, and Decentralised Finance (DeFi) businesses to investors and industry leaders, live on stage, in Accra, Ghana on October 3rd and 4th.

In today’s fast-evolving world of technology, the role of the tech sales professional is critical in bridging the gap between companies looking to move with the times and effect a digital transformation of operations, and those with the expertise to assist them.

Data analytics can facilitate economic and financial inclusivity in Africa by tailoring fintech solutions to meet the specific needs of communities, as exemplified by Mukuru.

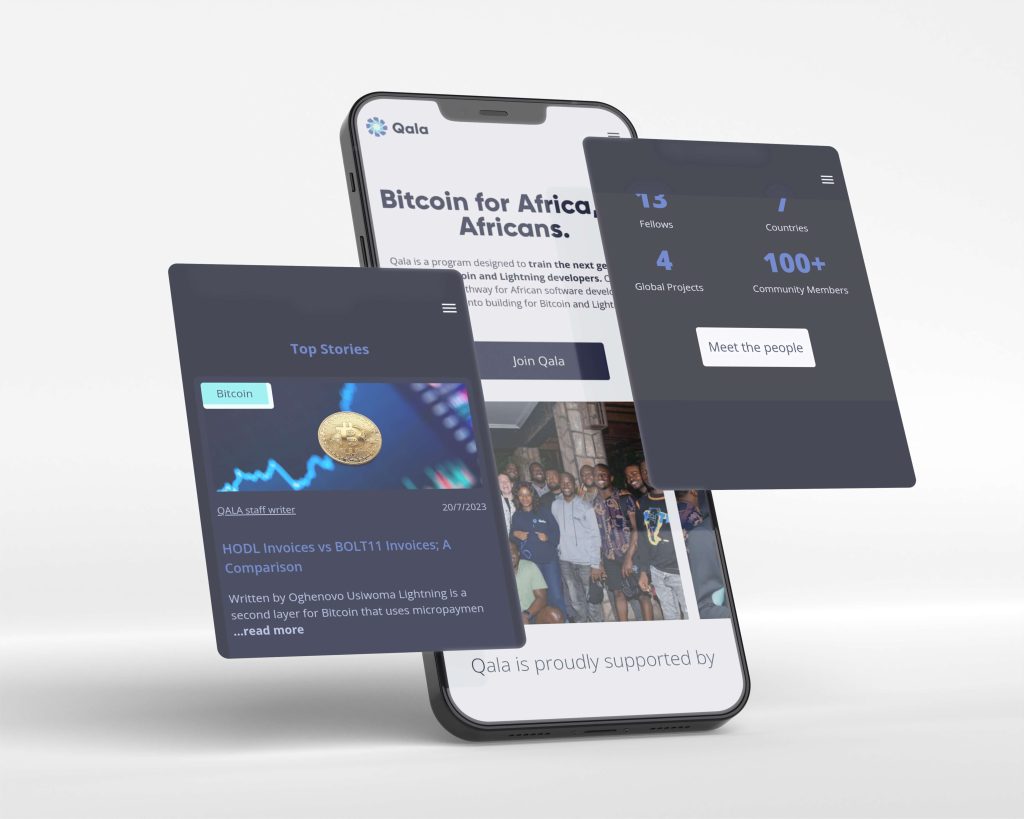

Jay-Z and Jack Dorsey-funded Bitcoin Non-profit Acquires Qala to Build Next Generation of Open-Source Bitcoin Developers