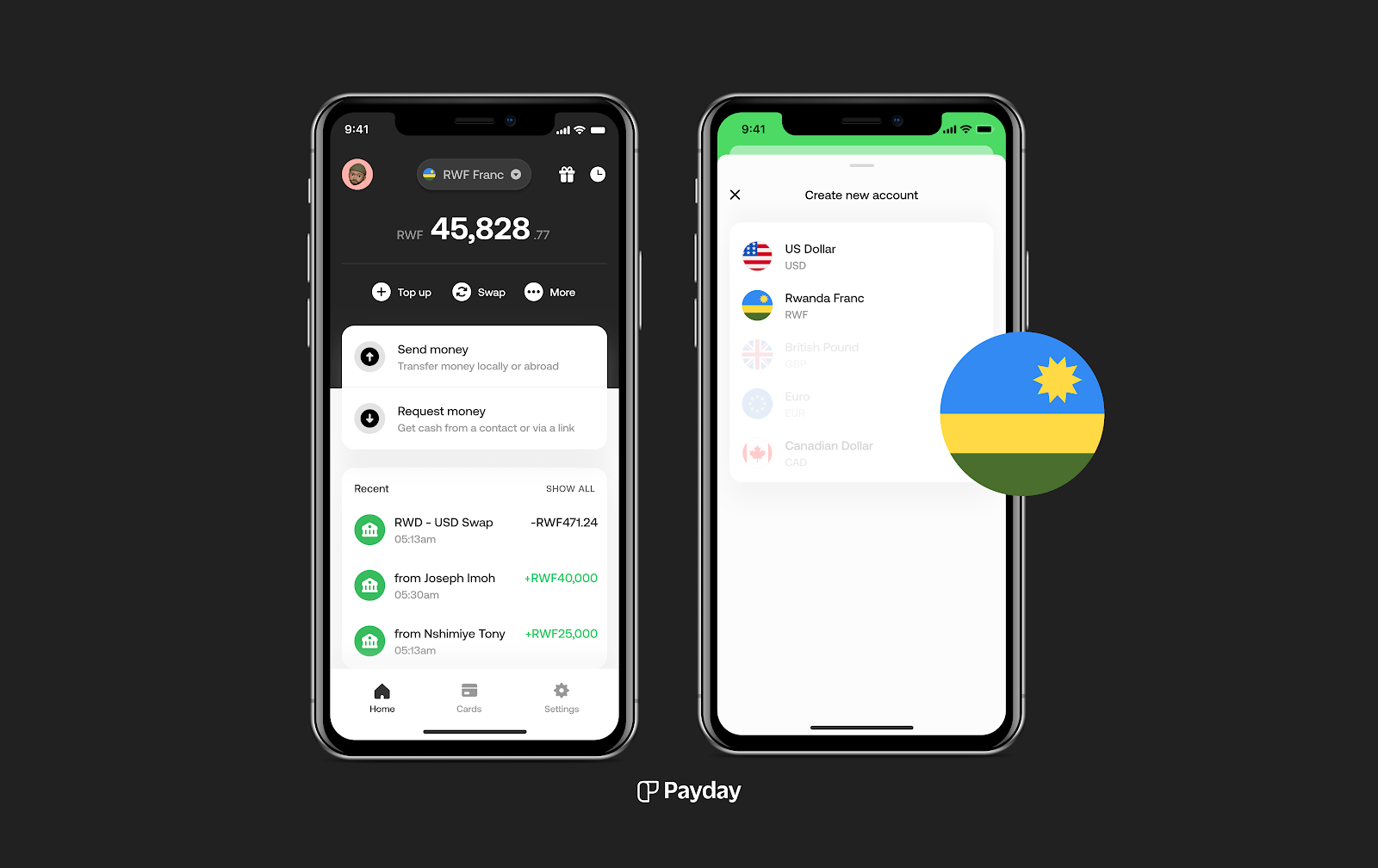

Africa’s leading neobank’s expansion into Rwanda aims at making digital banking accessible to all remote workers & professionals on the continent while ensuring access to […]

Category: Fintech

Fintech Africa

ETH Bot – How to Make Money With a ETH Bot

A trading bot is an automated software that connects to a crypto exchange and trades the coins of your choice in accordance with your pre-set […]

7th Edition Connected Banking Summit East Africa – Innovation & Excellence Awards 2023 Concludes with Resounding Success

The Summit brought together the best and brightest minds in the banking, financial services, fintechs and techfin sectors. The event, which took place on 7th […]

Unlocking Africa’s credit potential

Adrian Pillay, VP of Middle East & Africa at Provenir Fintech in Africa is coming into its own. According to KPMG data, there was a […]

Index Launch: Remittances Play a Powerful Role in Consumers’ Financial Planning

Inaugural Global Money Transfer Index surveys 30,600 consumers in 20 countries across the Middle East, Africa and Asia Pacific; Index voices consumers’ international money transfer […]

Amazon Web Services (AWS) opens applications for its inaugural FinTech Africa Accelerator

Amazon Web Services (AWS), the cloud computing division for the world’s largest e-commerce retailer, Amazon, continues to strengthen its footprint in Africa with a call-for-applications […]

Omnisient Wins Most Innovative Financial Inclusion Technology Award for Enabling Credit Access to the Unbanked in Africa

Omnisient, the South African FinTech that uses advanced analytics to enable the rapid discovery and monetization of data for financial inclusion, has won the Most […]

Ukheshe takes a fresh, dynamic approach to its African growth

The adage ‘jack of all trades, master of none’ is apt for enterprises considering expansion into new African markets. Anthony Karingi, Vice President of Business […]

Blockchain innovators flock to Joburg

Blockchain Africa is the continent’s biggest gathering of Web3 expertise and the crypto curious and it’s coming to Sandton on 16 and 17 March 2023 A […]

Fintech ImaliPay signs deal with Renda to empower e-commerce across Africa

ImaliPay, a leading fintech-as-a-service provider, has signed a major deal with 3rd Party e-commerce fulfillment solution Renda (1st March 2023). The partnership will support businesses across Africa […]