In this piece, Hortense Mudenge tells how financial inclusion can be a game-changer for African women across the informal economy.

Tag: FinTech

Cultivating a frictionless payment experience for merchant success

Wesley Fetter, Product Manager at Ecentric Payment Systems explains how cultivating a frictionless payment experience is key for merchant success.

Why an African-based, African-run payments partner with global insights is essential for success on the continent

The article delves into the dynamics of Africa’s payment ecosystem, highlighting the unique challenges faced in the continent, particularly in the Democratic Republic of the Congo (DRC).

Applications now open for Africa Fintech Summit’s 6th AlphaExpo Micro-Accelerator Cohort

The Africa Fintech Summit, the largest bi-annual fintech event in Africa, announces the application for its 6th AlphaExpo Micro-Accelerator cohort.

AWS announces the 25 startups selected for its first ‘fintech in Africa’ accelerator

Cohort participants from Kenya, Nigeria , South Africa, Egypt, Ghana, Uganda, and Cameroon 25 African fintech startups have been selected for the inaugural Amazon Web […]

Bridging the financial inclusion gap in South Africa requires simplicity and affordability

Financial inclusion remains a major challenge in South Africa, where millions of people remain outside the formal banking system and where higher-income groups have more […]

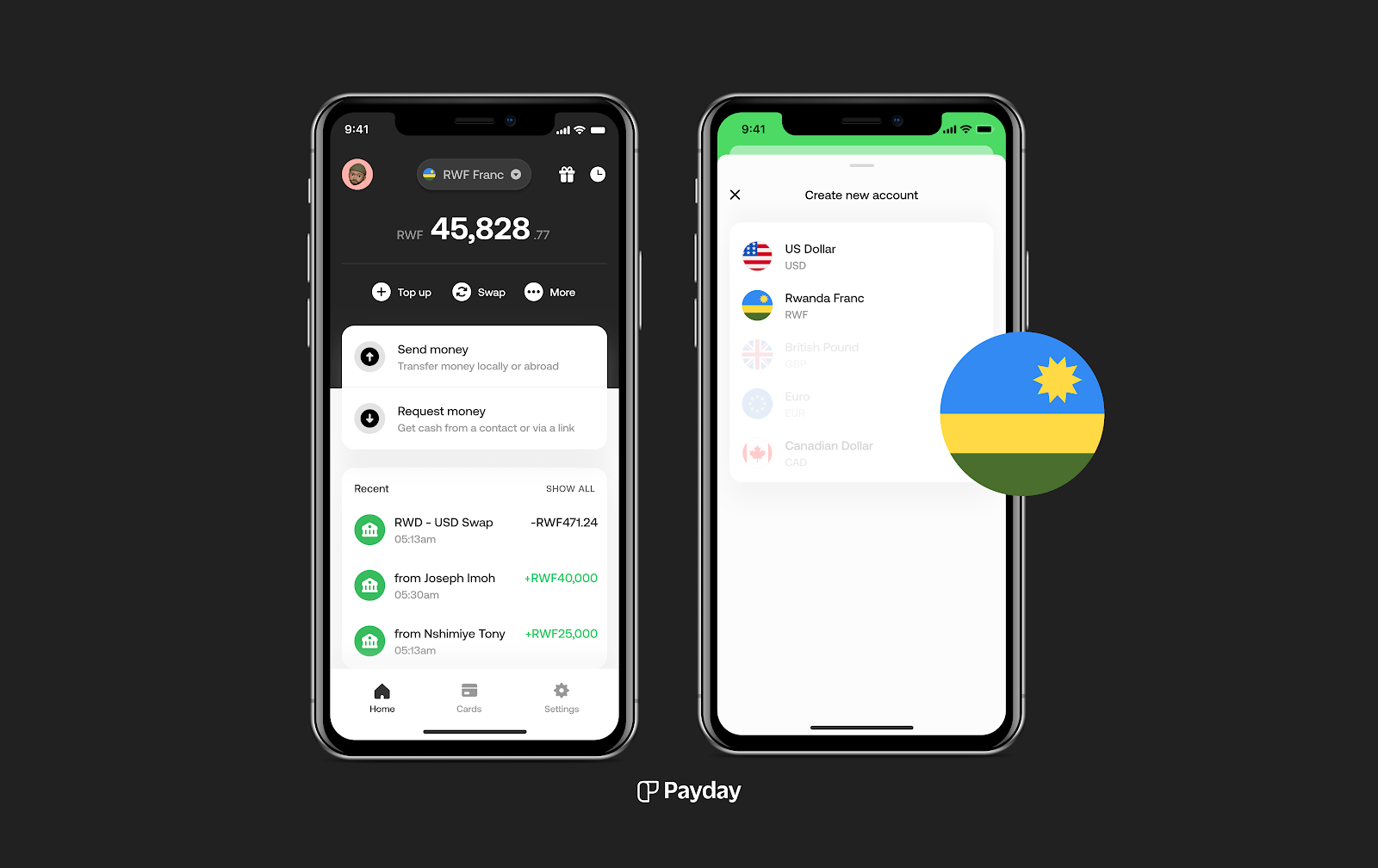

Payday re-launches in Rwanda with SpaceX’s Starlink

Africa’s leading neobank’s expansion into Rwanda aims at making digital banking accessible to all remote workers & professionals on the continent while ensuring access to […]

7th Edition Connected Banking Summit East Africa – Innovation & Excellence Awards 2023 Concludes with Resounding Success

The Summit brought together the best and brightest minds in the banking, financial services, fintechs and techfin sectors. The event, which took place on 7th […]

Unlocking Africa’s credit potential

Adrian Pillay, VP of Middle East & Africa at Provenir Fintech in Africa is coming into its own. According to KPMG data, there was a […]

Index Launch: Remittances Play a Powerful Role in Consumers’ Financial Planning

Inaugural Global Money Transfer Index surveys 30,600 consumers in 20 countries across the Middle East, Africa and Asia Pacific; Index voices consumers’ international money transfer […]