A survey by Statista found that around 32 percent of people in Nigeria use cryptocurrencies and this is the highest proportion of a population in […]

Tag: FinTech

M-KOPA Expands to Nigeria, Appoints Babajide Duroshola as New Country General Manager

Connected Asset Financing Platform Commercially Launching After 20,000 Device Pilot 12th July 2021. Lagos, Nigeria. M-KOPA, the leading connected asset financing platform, today announces it […]

Bushra Mahdi appointed as the Brand Ambassador for Tetra Pay International in the GCC and MENA region

Bushra Mahdi is appointed as the brand ambassador for Tetra Pay International INC for the countries in the GCC and the MENA alliance of nations. […]

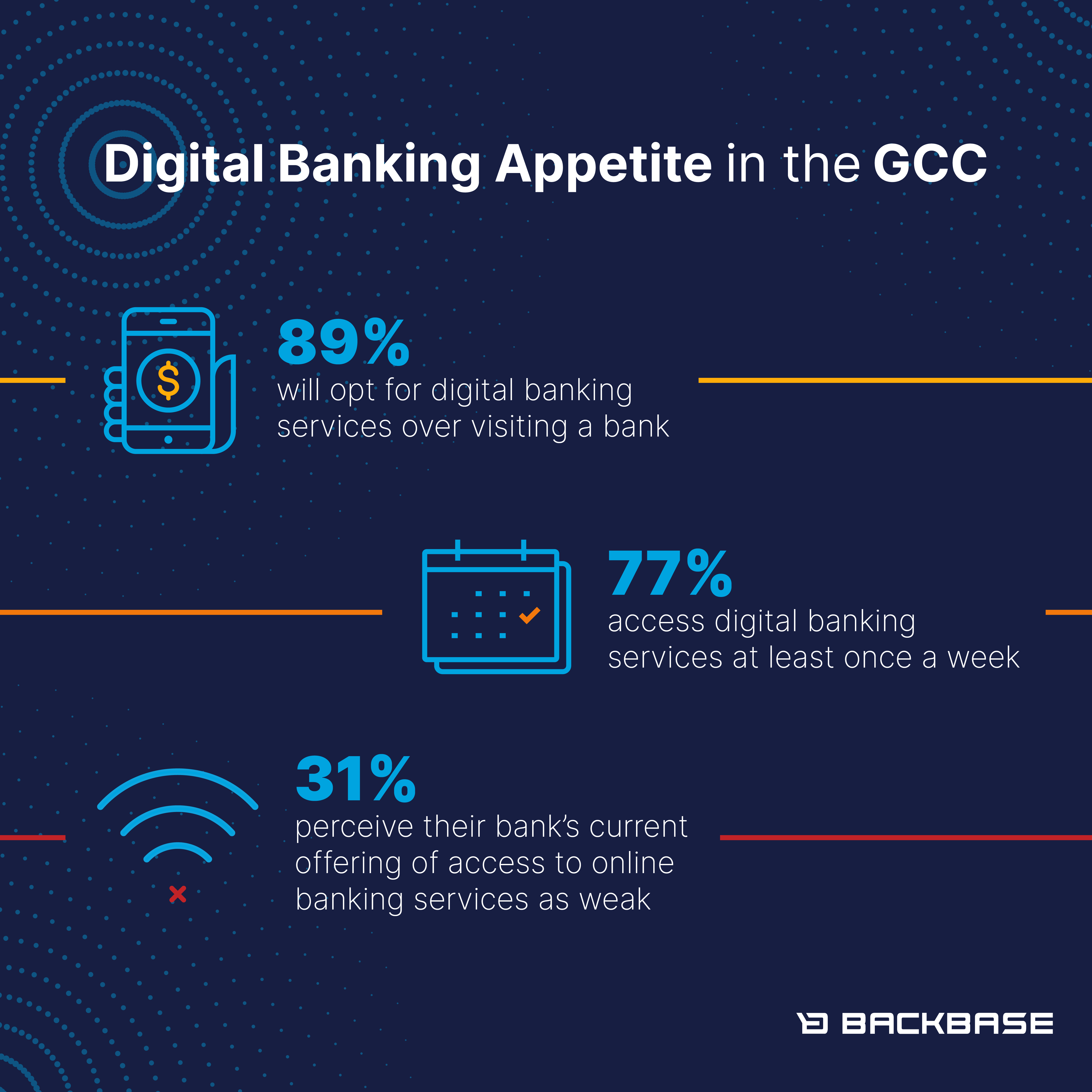

89% of GCC consumers will opt for digital banking services over visiting a physical branch post Covid-19

77% of respondents in the GCC access digital banking services at least once a week 44% are willing to switch to a different bank due […]

Telephonic payment solution helps companies deal with Covid-19 challenges

VerPay enables verbal commerce as businesses adapt to serve their customers in contactless ways As South Africa enters its third wave and lockdown restrictions tighten, […]

Securing the financial institutions’ physical and digital assets with biometrics

Gone are the days when the financial institutions’ (FI) only assets considered to be the gold, cash and other valuables in its vaults. With data […]

Fintech, Ofin, tackles behavioural changes needed to address financial inclusion

It is a common belief that financial access should lead to financial prosperity. According to the World Bank, financial inclusion is defined as all people […]

Venture Capital trends shaping the African investment landscape

As the second half of 2021 approaches and Covid-19 vaccinations roll out across the globe, albeit at varying rates, Ian Lessem, Managing Partner at HAVAÍC, […]

Official launch of the second cycle of EMERGING Mediterranean – the springboard programme for emerging Mediterranean Tech For Good leaders

The call for applications is open to any startup based in Mauritania, Morocco, Algeria, Tunisia or Libya that has been operating for over 18 months […]

South Africa’s Leading Payment Aggregator and Secure Payment Solutions Provider Expands into Africa

With the African Continental Free Trade Agreement set to generate combined consumer and business spending of $6.7 trillion by 2030[i], the continent requires payment platforms […]