Hollard, a leading Pan-African insurer, is bucking traditional marketing trends by using unconventional methods to drive financial literacy and encourage insurance uptake in cyclone-prone Mozambique through relatable, yet simple and effective techniques that are rapidly gaining traction.

Tag: insurance

Insurance has a crucial role to play in driving the sustainability of farming and give impetus to Zambia’s socio-economic development

With Zambia having recently commemorated Farmer’s Day and the contributions and work made by farmers in the agricultural sector in the country, Hollard has highlighted the importance of ensuring the sustainability of farming in the country, by providing adequate disaster risk financing mechanisms as a means to protect farmers against natural and man-made disasters.

Millennials will drive the growth of insurance in Africa

The insurance industry in Africa is undergoing significant transformation, marked by evolving consumer needs, technological advancements, and shifting demographics. Among the most influential demographic groups driving this change is the Millennials generation, born between 1982 and 1994. According to market research firm, IMARC Group, the African insurance industry is expected to grow by 6.3% between 2024 and 2032, after reaching US$ 87.4 billion by 2023.

The insurance industry comes under fire as the cost-of-living crisis increases

The world is currently facing one of the harshest economic climates experienced since the 2008 Global Financial Crisis, one of the worst financial crises in modern history. This raises concerns that more people may turn to fraud to address the financial pressure they are experiencing.

How a Hipster, a Hacker, and a Hustler built a booming business

Lessons from the insurtech start-up that caught the eye of industry giants While November has always been synonymous with National Entrepreneurship Month, you’d be forgiven […]

Growth and Progress of Kenya’s Insurance Market

AM Best company has published a report on the overall state of Kenya’s insurance market and how price competition hinders its growth potentials. The key […]

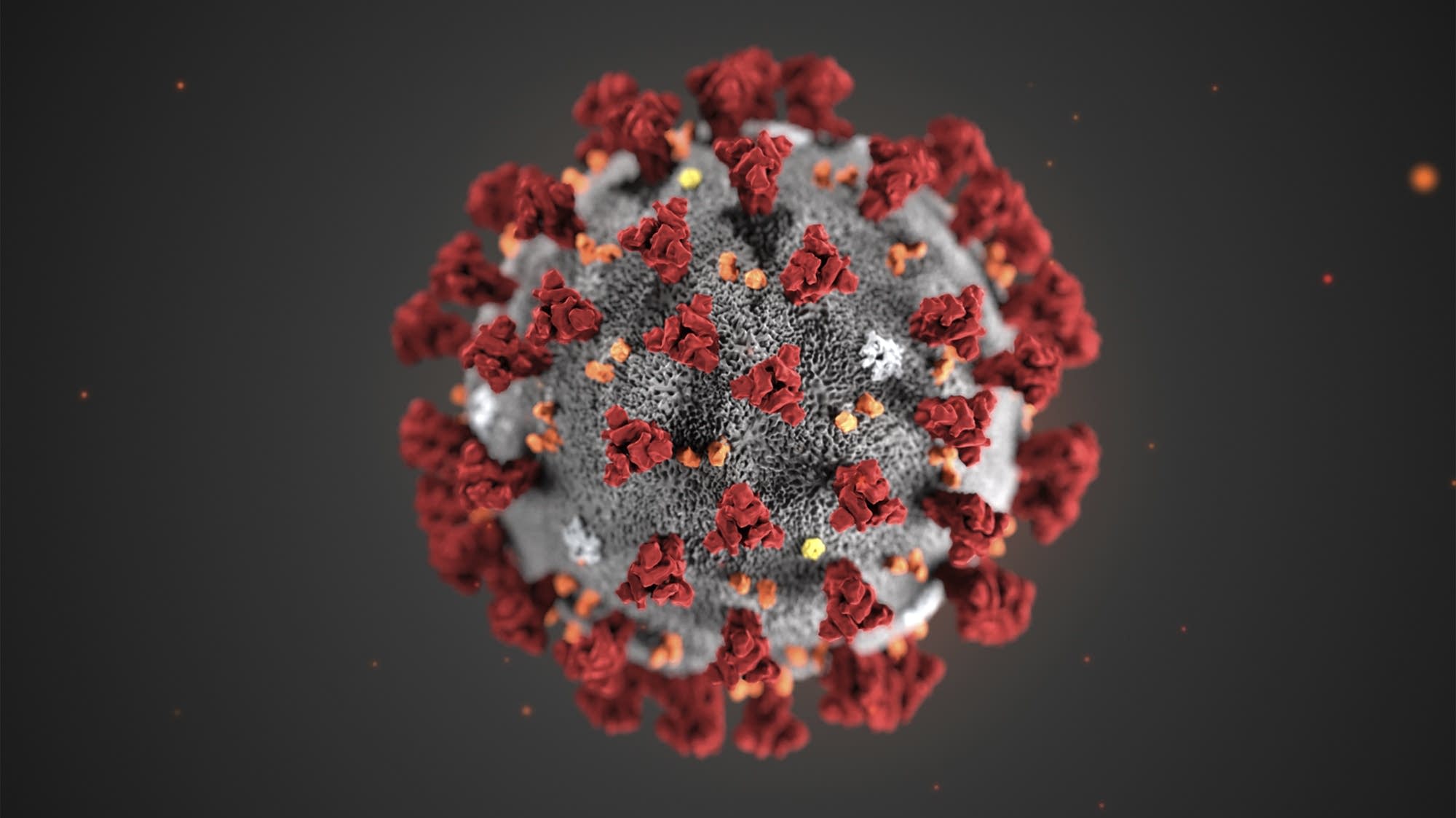

The impact of COVID-19 on finance and investment in Africa

By Morne van der Merwe, Managing Partner, and Wildu du Plessis, Head of Africa, Baker McKenzie Johannesburg The Coronavirus (COVID-19) has resulted in mass production […]

A ten-year strategy to support the development of social protection systems in Sub-Saharan Africa

STORY HIGHLIGHTS Social protection, which comprises both social assistance and social insurance programs, is a powerful tool to reduce poverty and vulnerability The World Bank […]

Professional Indemnity Insurance in South Africa

NEW YORK, Nov., 2012 /PRNewswire/ — Reportlinker.com announces that a new market research report is available in its catalogue: Professional Indemnity Insurance in South Africa […]

Payroll System: Small Businesses Can Print Paychecks on Blank Stock Easily with New EzPaycheck Software

Small business payroll software ezPaycheck was updated with new and more flexible features to allow users print paychecks and stubs on blank stock easily. Try […]