The adoption of the latest version of 3D Secure authentication for online payments has significantly increased around the world, according to a new report by […]

Tag: Online Payments

Big Fintech Company “Opportunities” for Small Businesses or Mousetrap for Your Money

This small post contains unpleasant moments from Fintech companies that small companies or entrepreneurs face. Best Online money transfer, Best Digital payment services… = High […]

2021: The year of the online payment

As the world moved indoors two years ago, the online payment space flourished. These are the biggest developments in 2021, and a brief look ahead. […]

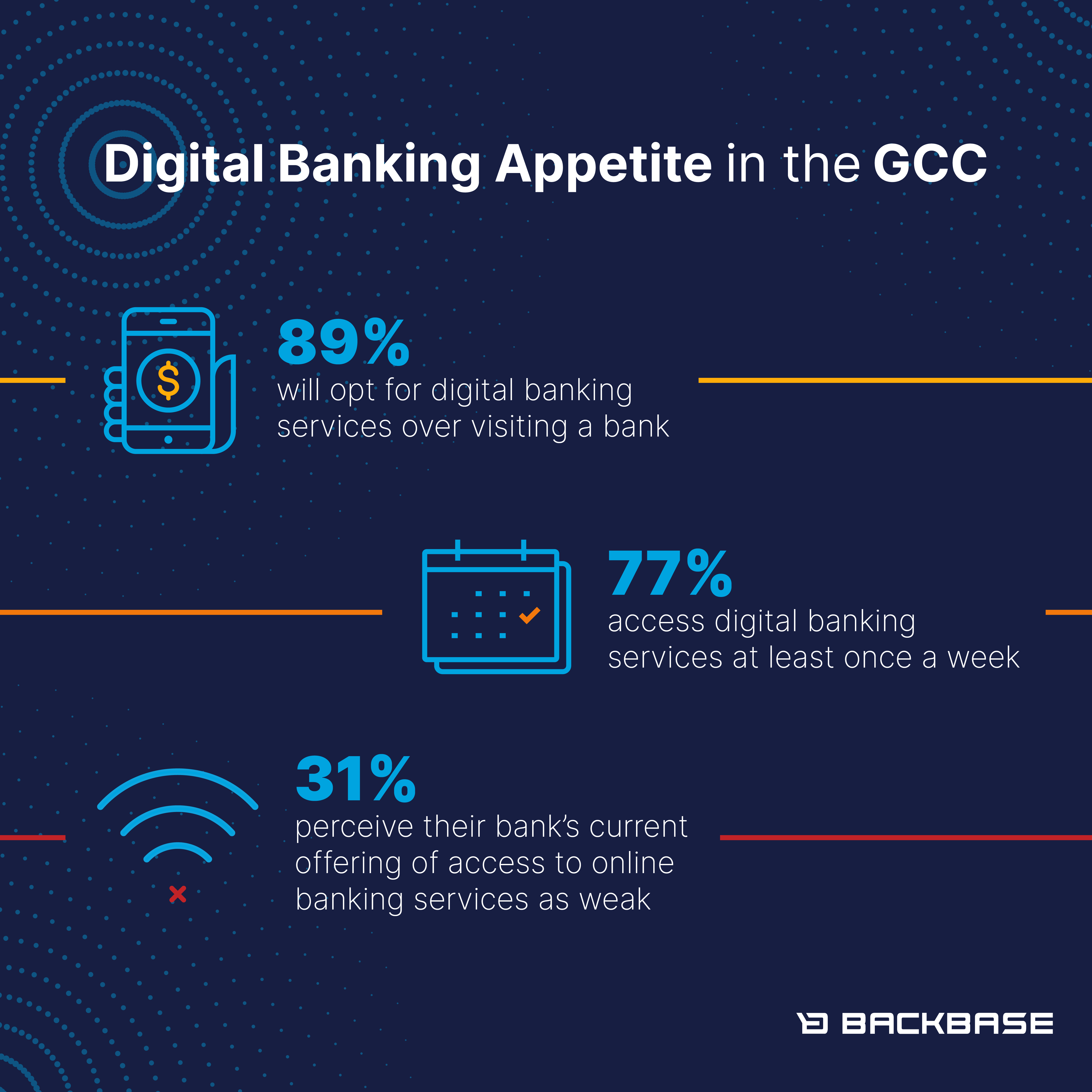

89% of GCC consumers will opt for digital banking services over visiting a physical branch post Covid-19

77% of respondents in the GCC access digital banking services at least once a week 44% are willing to switch to a different bank due […]

Ajua Acquires WayaWaya

Leading Customer Experience Platform for Africa to Integrate Intelligent Messaging and Payments Platform Across its Product Suite Ajua, the integrated Customer Experience Management solution for […]