“Africa’s new bank for startups and SMEs” to expand to South Africa & Kenya following funding Brass, a Nigerian digital bank delivering easy access to affordable premium banking services for small and medium-sized businesses (SMEs), has today secured $1.7mn in funding to address the heavily underserved banking needs of local entrepreneurs, traders and fast-growing businesses. […]

Tag Archives: financial technology

Peach Payments is pleased to announce that it has set up an office in Mauritius recently in pursuit of its pan-African expansion strategy. As a FinTech start-up that was set up in South Africa in 2012 and expanded into Kenya in 2018, the company is set to make a significant contribution to the pan-African FinTech landscape […]

Incumbent banks are starting to look to “platform banking” to stay relevant and loved by customers. But what is platform banking in the first place? And why is it a good thing for society? Anthony de Gray Birch, co-founder and Chief Operating Officer (COO) of Direct Transact, South Africa’s biggest banking enabler of the past […]

In 2020, e-commerce in South Africa spiked by 66%, driven by COVID-19-induced lockdowns and a drop in brick-and-mortar retail sales[i]. This increase was accompanied by an upsurge in the use of instant Electronic Funds Transfer (EFT) payments. Towards the end of last year however, the SA Reserve Bank, Payment Association of South Africa (PASA), and […]

The global pandemic has ushered in a new paradigm for the Retail Banking sector, one which demands quicker transformation to a customer-centric service that is digitised, personal and convenient. A recent Financial Industries panel discussion held by Kearney, a global consultancy, shed light on how the power of data, Application Programming Interfaces (APIs) and automation […]

Connected Asset Financing Platform Commercially Launching After 20,000 Device Pilot 12th July 2021. Lagos, Nigeria. M-KOPA, the leading connected asset financing platform, today announces it has officially expanded to Nigeria. To lead the Nigeria team, M-KOPA has named Babajide Duroshola as the new General Manager. A part of the tech company’s broader expansion strategy, the […]

Bushra Mahdi is appointed as the brand ambassador for Tetra Pay International INC for the countries in the GCC and the MENA alliance of nations. Leading Instagram influencer, Bushra has over 299 thousand followers on her Instagram page making her a youth icon. She is also the founder of Red Films, owing to her passion […]

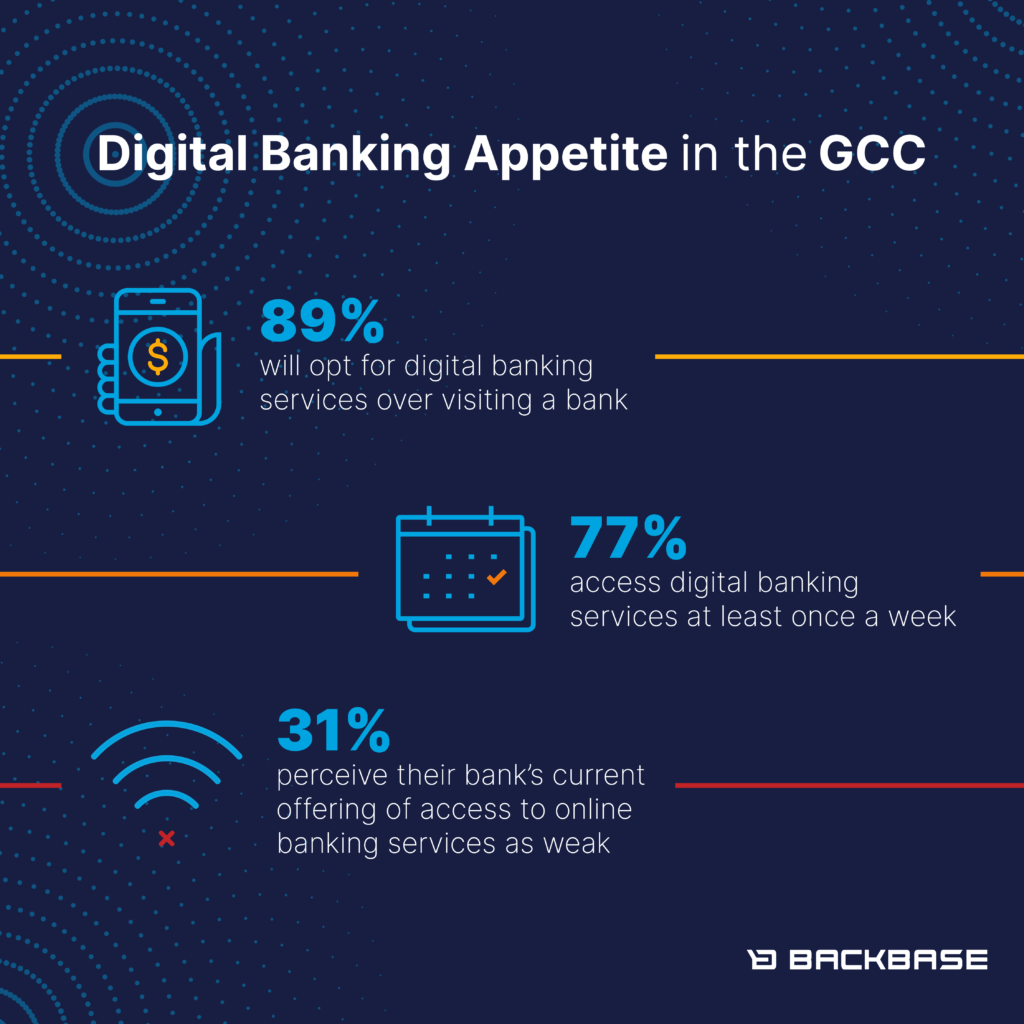

77% of respondents in the GCC access digital banking services at least once a week 44% are willing to switch to a different bank due to poor customer relations 31% perceive their bank’s current offering of access to online banking services as weak Consumer appetite for digital banking services continues to grow in the countries […]

VerPay enables verbal commerce as businesses adapt to serve their customers in contactless ways As South Africa enters its third wave and lockdown restrictions tighten, certain businesses – such as those in hospitality – once again find themselves having to temporarily close their doors, while seeking alternative avenues to generate income, such as take-aways. “The […]

Gone are the days when the financial institutions’ (FI) only assets considered to be the gold, cash and other valuables in its vaults. With data widely acknowledged as the new gold, ensuring that only legitimate people get access into the FI’s premises and digital databases is more important than ever By: Nicolas Garcia, VP MEA, […]

- 1

- 2